In the world of investing, one of the most crucial elements to success is managing risk. The market is inherently volatile—especially in the current climate of 2024, with inflation concerns, geopolitical tensions, and technological disruptions shaping the financial landscape. But how can we, as investors, navigate these choppy waters and avoid getting swept away by market fluctuations?

Enter the concept of Dollar-Cost Averaging (DCA)—a strategy that has proven itself over decades as one of the best ways to lower market volatility risk. By utilizing DCA, investors can avoid the common pitfall of trying to time the market, a gamble that even seasoned professionals rarely win. Instead, DCA offers a more disciplined and effective approach, especially for long-term investors.

Understanding Dollar-Cost Averaging (DCA)

Before diving into how DCA can help mitigate market volatility, it’s essential to first understand what this strategy involves.

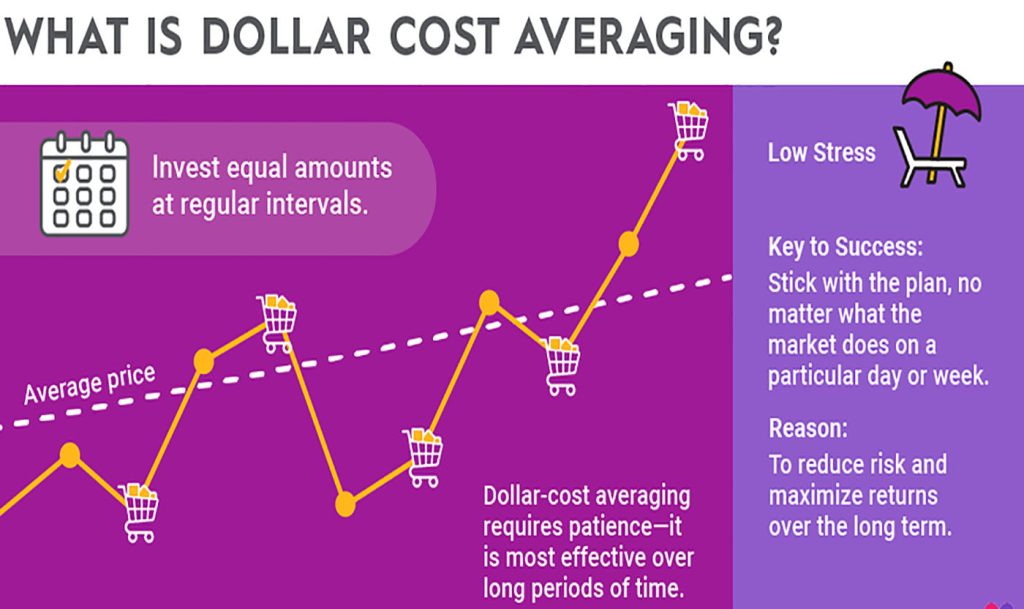

Dollar-Cost Averaging is an investment strategy where you invest a fixed amount of money into a specific asset or portfolio at regular intervals, regardless of the asset’s price. The idea is to buy more shares when prices are low and fewer shares when prices are high. Over time, this approach averages out the cost of your investment, reducing the impact of short-term market volatility.

For example, if you plan to invest $1,000 per month into a particular fund, some months you’ll purchase more shares when the price is low, and other months, fewer shares when the price is high. The result is that you don’t need to worry about timing the market and trying to predict short-term price movements, which is often a losing battle.

Why Dollar-Cost Averaging Is Effective in 2024

The year 2024 presents a unique set of challenges and opportunities for investors. We’re seeing persistent inflation, interest rate adjustments, and fluctuating market sentiment. These factors can cause significant swings in asset prices, leaving many investors feeling uncertain about how to proceed.

In such an environment, the benefits of DCA become even more pronounced:

1. Reducing the Impact of Market Timing

Trying to time the market—buying when prices are low and selling when they’re high—sounds easy in theory but is incredibly difficult in practice. Even expert investors can’t predict short-term market movements consistently. DCA eliminates the need for timing the market by spreading your investment over time, reducing the risk of making a large investment just before a market downturn.

2. Smoothing Out Market Volatility

When the market experiences sharp upswings or downturns, DCA helps smooth out these fluctuations. Since you’re regularly investing the same amount, you’re naturally buying fewer shares when prices are high and more shares when prices are low, which helps reduce the impact of volatility over the long run. In essence, it’s like “buying the dip” without having to worry about it.

3. Avoiding Emotional Investing

One of the biggest challenges for individual investors is dealing with emotions during market swings. When prices are falling, it’s easy to panic and sell off investments. On the flip side, during bull markets, investors often get greedy and overextend themselves. DCA can help reduce emotional decision-making by automating your investment process and ensuring you stay committed to your long-term strategy, regardless of short-term market movements.

4. Long-Term Focus

DCA is a strategy that thrives on a long-term perspective. By committing to regular investments over time, you’re setting yourself up for gradual wealth accumulation, and potentially benefiting from compound growth. When you focus on long-term goals, daily market fluctuations become less relevant.

How Dollar-Cost Averaging Mitigates Market Risk

Market volatility, especially in the current economic landscape, can feel overwhelming. But the reality is that these fluctuations are normal—and part of the reason why the stock market has delivered strong returns over time. What’s critical is how we respond to those fluctuations. This is where DCA excels.

Let’s look at how DCA directly addresses the risks associated with market volatility:

1. Avoiding Buying High and Selling Low

One of the most critical aspects of risk management is avoiding the trap of buying when prices are high, only to sell when prices dip. DCA helps you sidestep this issue by distributing your investments across different market conditions. Because you’re investing a fixed amount at regular intervals, you aren’t trying to predict the best time to buy. Over the long term, this can result in a better average purchase price, even if the market is volatile.

2. Protecting Against Short-Term Market Swings

In the short term, markets can experience rapid price swings due to various factors: corporate earnings reports, geopolitical events, or macroeconomic changes like changes in interest rates. When you use DCA, you reduce your exposure to short-term market swings. Rather than reacting to market news, you stick to a disciplined, consistent approach to investing.

For example, if you had invested $10,000 at the peak of a market rally, your portfolio could have seen a significant drop if the market corrected shortly afterward. However, if you used DCA and invested $1,000 per month, the market fluctuations would have been smoothed out over time.

3. Smoothing Out Emotional Responses to Volatility

One of the biggest risks during volatile periods is emotional investing. In periods of downturns, many investors sell off their positions in fear of further losses. Conversely, during periods of growth, investors may overextend themselves, betting too heavily on high-risk investments. DCA works against these impulses by setting a schedule of regular investments, which takes emotion out of the equation. It’s a strategy that requires you to stay consistent, regardless of market conditions.

How to Start Using Dollar-Cost Averaging

Implementing a DCA strategy is straightforward. Here’s a step-by-step guide to get started:

1. Determine Your Investment Amount

Start by deciding how much money you want to invest each month. This should be an amount that you’re comfortable with and that fits within your budget. If you’re new to investing, it’s recommended to start small and gradually increase your contributions as you get more comfortable with the process.

2. Choose Your Investment Vehicle

While DCA can be applied to any type of investment, it’s most commonly used with mutual funds, exchange-traded funds (ETFs), and individual stocks. Index funds and ETFs, which track the broader market or specific sectors, are excellent choices for DCA because they offer diversification and have low management fees.

For example, Vanguard offers several low-cost index funds that are perfect for a DCA strategy. You can also look at ETFs like SPDR S&P 500 ETF (SPY), which tracks the S&P 500, providing broad exposure to the market. Similarly, Fidelity offers a range of investment options suitable for DCA.

3. Automate Your Investments

One of the best ways to implement DCA is to set up an automated investment plan. Most online brokerages, such as Charles Schwab and Fidelity, allow you to set up automatic contributions from your bank account to your investment account. By automating your investments, you remove the temptation to time the market or stop investing during periods of market volatility.

4. Stick to Your Plan

The key to successful DCA is consistency. Stay disciplined and continue contributing to your investments regularly, even during periods of market downturns. It’s tempting to stop investing when the market drops, but this is often when you’re purchasing shares at a lower price. Over time, these regular contributions will compound and grow your wealth.

Websites and Tools to Help with Dollar-Cost Averaging

There are several resources available that can assist you in applying DCA and tracking your investments. Here are some useful websites and tools:

- Vanguard – Vanguard offers a broad selection of low-cost index funds and ETFs, which are perfect for DCA strategies. They also have an easy-to-use platform for automating your investments.

- Fidelity – Fidelity offers automated investing plans with low fees and a wide range of investment options, making it easy to set up regular contributions to your portfolio.

- Charles Schwab – Schwab’s platform is another excellent choice for automating DCA investments and offers a variety of commission-free ETFs and mutual funds.

- Personal Capital – If you want to track the performance of your investments and calculate the potential returns of your DCA strategy, Personal Capital is a great tool to help you monitor your portfolio’s growth over time.

- Morningstar – For in-depth research on funds and ETFs, Morningstar offers comprehensive data and analysis to help you choose the best investment vehicles for your DCA strategy.

Dollar-Cost Averaging is a powerful strategy that can help you manage the risks associated with market volatility, especially in today’s uncertain economic climate. By committing to regular investments, you can reduce the emotional burden of investing and avoid making impulsive decisions during periods of market fluctuation.

If you stick to a disciplined DCA approach, you’re not only minimizing your exposure to market timing risks but also setting yourself up for long-term financial success. With platforms like Vanguard, Fidelity, and Charles Schwab, the process of implementing DCA has never been easier.

So, whether you’re a beginner or a seasoned investor, DCA can be the key to navigating the rollercoaster of market volatility and achieving steady, long-term growth. Remember, consistency is key—stay committed to your plan, and the rewards will follow.