Researching investments in 2025 isn’t what it used to be. I remember just a few years ago, I’d sit down with half a dozen tabs open—Bloomberg, Yahoo Finance, SEC filings, forums, Twitter threads—and try to cross-reference data manually. It was exhausting and, frankly, inefficient. Today, with AI tools integrated into everything from stock screeners to news feeds, the expectation isn’t just thorough research—it’s fast, data-driven, and smarter than ever.

That’s where Chrome extensions have stepped up. These lightweight browser add-ons are no longer just about blocking ads or checking grammar. Some of the best ones have become indispensable weapons in my investing arsenal. Whether I’m screening undervalued European REITs or tracking macro indicators from the ECB, Chrome is now my research HQ—and these five extensions are the tools I rely on most.

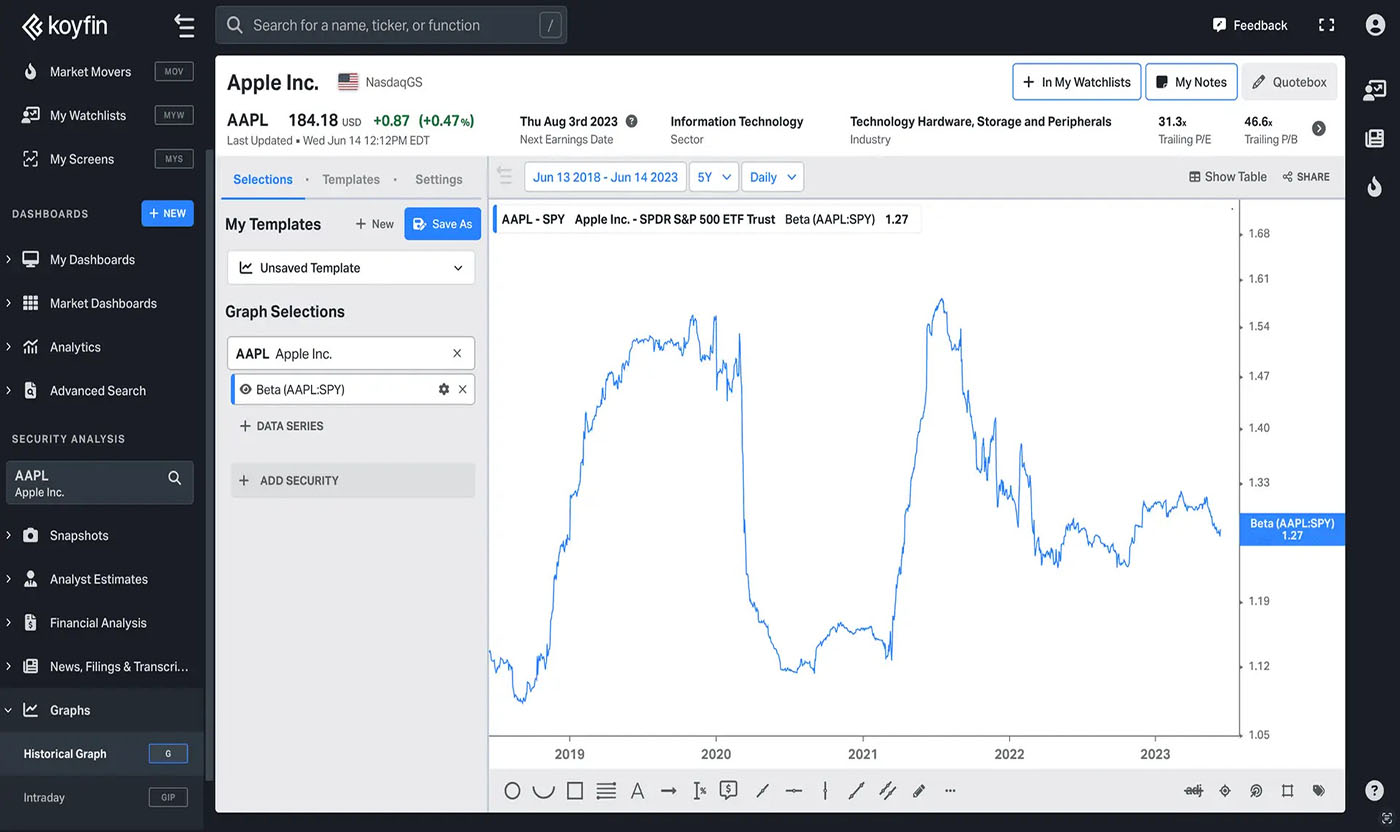

1. Koyfin Web Clipper – Snapping Context at Speed

Koyfin has been one of my favorite platforms for visualizing financial data for a while now, but their Chrome extension brings something especially valuable to the table: context preservation. When I’m deep-diving into a specific stock or ETF, I often come across nuggets buried in long articles—whether from Seeking Alpha, FT, or niche Eurozone reports.

With Koyfin’s web clipper, I can instantly highlight, annotate, and save key data points into my dashboard. The best part? It automatically tags the source, attaches the timestamp, and integrates it with related tickers or macro themes. For someone who follows European dividend trends and U.S. yield curve dynamics side-by-side, this feature is priceless.

Bonus Tip: Koyfin itself is great for building watchlists based on ROE, dividend yield, and volatility—especially when you’re comparing REITs across Germany, France, and the UK.

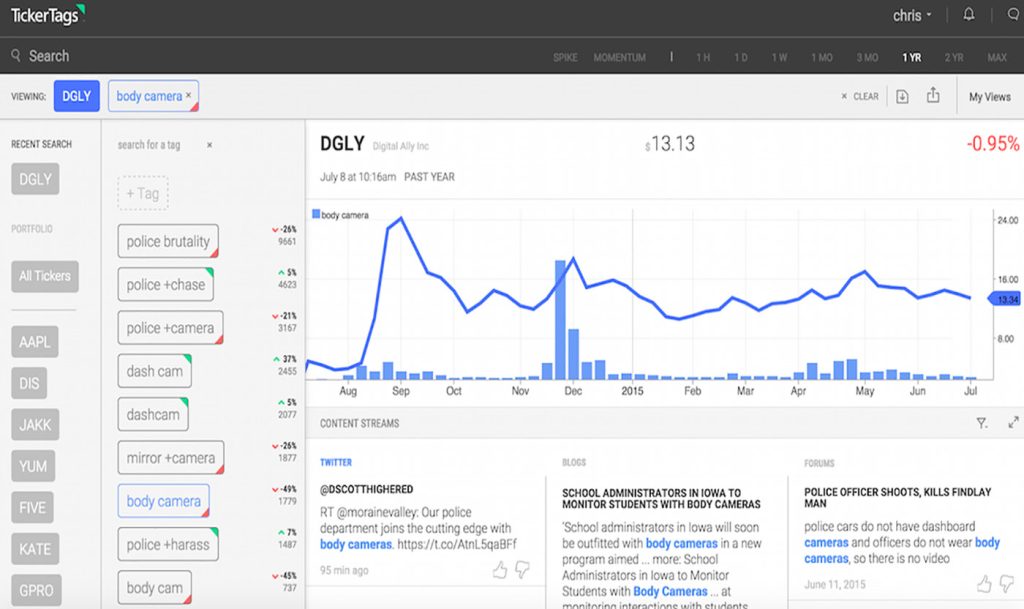

2. TickerTags – Turning News into Signals

In 2025, social sentiment isn’t noise—it’s a signal. TickerTags, once popular for parsing Twitter conversations, has evolved into a Chrome extension that now plugs directly into your browsing experience. As you scroll through a news article on, say, The Wall Street Journal, the extension highlights key themes, brands, and market events in real time.

When I was tracking interest rate policies across the Eurozone earlier this year, TickerTags was flagging terms like “rate pause,” “ECB liquidity,” and “quantitative tightening” long before the narrative caught mainstream fire. It turned a routine ECB summary into a string of actionable tags I could plug directly into my research notes.

Sites it works great with: CNBC, Reuters, Bloomberg, and regional publications like Les Échos or Handelsblatt.

3. Finbox – Valuation Models on the Fly

Finbox has always been strong on fundamentals, but the extension takes it further: it brings discounted cash flow (DCF), EBITDA multiples, and other valuation metrics directly into your browser. No more flipping back and forth between spreadsheet templates or exporting CSVs from company filings.

The plugin recognizes when you’re visiting a financial news article or investor relations site and offers to run a quick valuation on the mentioned stock. Last month, when I was analyzing Swiss real estate ETFs, Finbox helped me compare P/FFO multiples across five tickers in under ten minutes—all without leaving the tab I was in.

What impressed me most recently is how Finbox syncs with Morningstar, Simply Wall St., and even MarketWatch. If you’re juggling multiple tabs like I often am, this saves a ridiculous amount of time.

4. Momentum – Stay Focused, Stay Profitable

Let’s face it—staying focused in the digital age is brutal. Just one tab away from that 10-K filing is a YouTube rabbit hole or a viral Reddit thread. Momentum doesn’t just replace your new tab screen with scenic images—it gives you focus prompts tailored to your goals. You can even set it to remind you of the specific research task you’re on.

In my case, I use it to remind me of deadlines for earnings reviews, sector rotations I’m tracking, or technical charting I need to finish for my monthly equity reports. It might sound simple, but building that muscle for sustained focus has dramatically improved my decision-making speed.

Real-life scenario: While analyzing Dutch infrastructure REITs this quarter, I kept seeing news about renewables tucked away in ESG reports. With Momentum keeping me zeroed in on my research goal, I didn’t wander—and ended up spotting a merger opportunity ahead of most.

5. Zigzag – One Plugin to Visualize Everything

Zigzag is a relative newcomer in the research tool space, but it’s changed the way I map out investment narratives. Think of it as mind-mapping for finance: it lets you turn links, quotes, images, and insights into a real-time visual map. For long-term thematic investors like me, this is gold.

In March, I was researching real estate tokenization and came across a sea of fragmented articles. Zigzag allowed me to pin each piece, connect trends, track regulatory mentions, and organize data into sub-narratives—like “MiCA regulation” or “fractional ownership in Austria.”

The map now lives as a live document in my browser, updating whenever I revisit a linked site. It’s like having a Bloomberg Terminal but visually driven and accessible.

Why Chrome Extensions Are Now a Core Part of My Investment Toolkit

Back in 2020, the average investor’s toolkit included spreadsheets, newsletters, perhaps a Bloomberg subscription (if your budget allowed), and a lot of manual analysis. But fast forward to 2025, and browser extensions have quietly become the connective tissue between raw data and real insight.

These aren’t gimmicks. They’re research infrastructure. They’ve enabled me to:

- Aggregate market insights from both U.S. and European news outlets,

- Automatically apply valuation metrics as I browse annual reports or filings,

- Structure complex macro themes into manageable, interactive outlines,

- Filter emotional noise from social media chatter and distill true sentiment signals.

In an age where real-time research equals real-time advantage, each of the five extensions I listed above has directly improved both the speed and clarity of my investing decisions.

A Look at My Current Research Flow with These Plugins

Let me walk you through a typical session from earlier this year when I was evaluating infrastructure REITs across Europe—mainly in Germany, Belgium, and the Netherlands. These sectors had lagged post-COVID recovery and showed signs of bottoming out, with interest rate policy from the ECB starting to stabilize.

Step 1: News Scanning (TickerTags + Koyfin)

I started the day browsing Financial Times, De Tijd (Belgium), and Les Échos. As I read articles about EU construction sector projections and German property regulations, TickerTags began highlighting patterns—mentioning themes like “green bond funding,” “industrial conversion,” and “rent cap reform.”

I saved the most relevant snippets using Koyfin Web Clipper, tagging each one with project names and estimated impact ranges. My dashboard was already starting to tell a story—and I hadn’t opened a spreadsheet yet.

Step 2: Quick Valuation Check (Finbox)

Before diving into earnings reports, I pulled up the investor relations pages of REITs like Aroundtown SA (Germany) and Cofinimmo (Belgium). The Finbox extension ran instant DCF models on the side of the screen, flagging discrepancies between market price and intrinsic value.

This helped me spot that Cofinimmo was potentially undervalued by ~15% based on conservative NOI growth—even before I opened their annual report.

Step 3: Visualizing the Landscape (Zigzag)

I then switched to Zigzag, where I mapped out the evolving narrative: declining yield spreads, regional tax reforms, increasing energy efficiency requirements for real estate portfolios. The mind map format made it easy to compare policy developments across countries and overlay company-specific strategies.

This visualization helped me see not only where value might emerge, but also what external pressures could suppress price momentum over the next two quarters.

What About Security and Privacy?

One concern I often hear from other investors is whether these Chrome extensions compromise data security. It’s a valid worry—especially when working with sensitive research notes or personal watchlists.

Here’s what I do:

- I only install extensions from verified developers with solid reputations and transparent privacy policies.

- I regularly review Chrome’s permissions page to ensure no extension is accessing unnecessary browsing data.

- I use password managers like Bitwarden and VPNs like ProtonVPN when accessing any financial account or brokerage interface.

What Other Tools Do I Combine With These Extensions?

These extensions aren’t standalone tools—they integrate into a larger research ecosystem. I pair them with the following platforms to get a full spectrum of insight:

- Seeking Alpha – Still the best place for crowd-sourced fundamental insights.

- TradingView – Especially helpful when I want to mark up charts on the fly.

- Finviz Elite – My go-to for screening undervalued stocks with technical indicators.

- Morningstar Direct – For fund comparisons and performance breakdowns.

- Yahoo Finance Premium – Surprisingly underrated for tracking dividend history and insider transactions.

And when I want to compare telecom deals, data plans, or evaluate mobile tools for trading (especially if I’m traveling in Europe), I turn to:

- WhistleOut (US & UK) – Great for comparing mobile data and device plans.

- TigerMobiles (UK) – For business mobile bundles with secure communications.

- HighSpeedInternet.com – A hidden gem for comparing ISPs and speed ratings in different zip codes or EU cities.

The Plugins I’m Watching Next

Even though I already have a robust setup, I’m always experimenting with new extensions that might improve my workflow. Here are a few I’ve bookmarked for testing in Q3 2025:

- AlphaSense Reader – It just launched a browser plugin version and could be a game changer for parsing earnings calls and transcripts.

- ParseIQ – An AI tool for extracting key ratios and anomalies from PDFs like 10-Ks and ESG reports.

- BrowserGPT – A multi-tab summarization tool that’s ideal for scanning 20+ pages of macroeconomic data.

The Real Value: Compounding Your Edge

When I first started using these extensions, I was hoping to save time. What I didn’t expect was that they’d actually improve the quality of my investment decisions. That’s because real investing isn’t just about raw data—it’s about how you synthesize, remember, and connect the dots. These Chrome tools help me do that faster, better, and with less friction.

I’m not chasing alpha with Chrome extensions. But I am building an edge that compounds over time: tighter narratives, fewer missed insights, faster conviction, and ultimately, better trades.

If you’re a serious investor, 2025 demands a serious browser setup. Chrome remains the most versatile platform for investment research because of its open plugin ecosystem—and these five extensions have turned my browser into a full-blown investment cockpit.

Whether you’re a long-only dividend investor, a macro trader, or a sector rotation strategist, your competitive advantage lies in how efficiently you can turn information into insight. With tools like Finbox, TickerTags, and Zigzag, your edge might be just a browser window away.

Let these tools work while you think. Let your research breathe while the plugins do the heavy lifting. And let your time go where it belongs: high-leverage thinking and high-conviction investing.