Navigating the world of car insurance can feel like stepping into a labyrinth. In 2025, the landscape of automotive coverage in Europe and North America has evolved, reflecting changes in technology, regulations, and consumer expectations. I’ve spent years analyzing insurance policies and breaking down their real-world impact, and today I want to walk you through the eight major types of car insurance. By the end of this guide, you’ll understand not just what these coverages are, but also how to choose the ones that genuinely make sense for you, your vehicle, and your budget.

1. Liability Insurance: Protecting Yourself from Legal and Financial Burdens

Liability insurance is the backbone of car insurance policies and is legally required in almost every state in the U.S. and most European countries. It’s designed to cover the financial consequences if you’re responsible for an accident. But liability insurance itself has two key components:

Bodily Injury Liability (BIL): This covers medical expenses, rehabilitation costs, and legal fees if someone else is injured in an accident you caused. It also often covers lost wages and other related damages.

Property Damage Liability (PDL): This part covers damage to other people’s property—cars, fences, buildings, or even landscaping. Essentially, if your driving causes harm to someone else’s possessions, this coverage picks up the tab.

For example, in my experience reviewing dozens of policies, I found that many drivers underestimate how quickly costs can escalate. Imagine an accident where you damage a luxury vehicle worth \$60,000 while your policy limit is only \$50,000. You’d be responsible for the remaining \$10,000. To avoid this, consider opting for higher limits if your budget allows.

Pro tip: NerdWallet (nerdwallet.com) is an excellent resource for comparing liability coverage levels and premiums across multiple insurers. They allow you to see the financial trade-offs of different coverage options in real time.

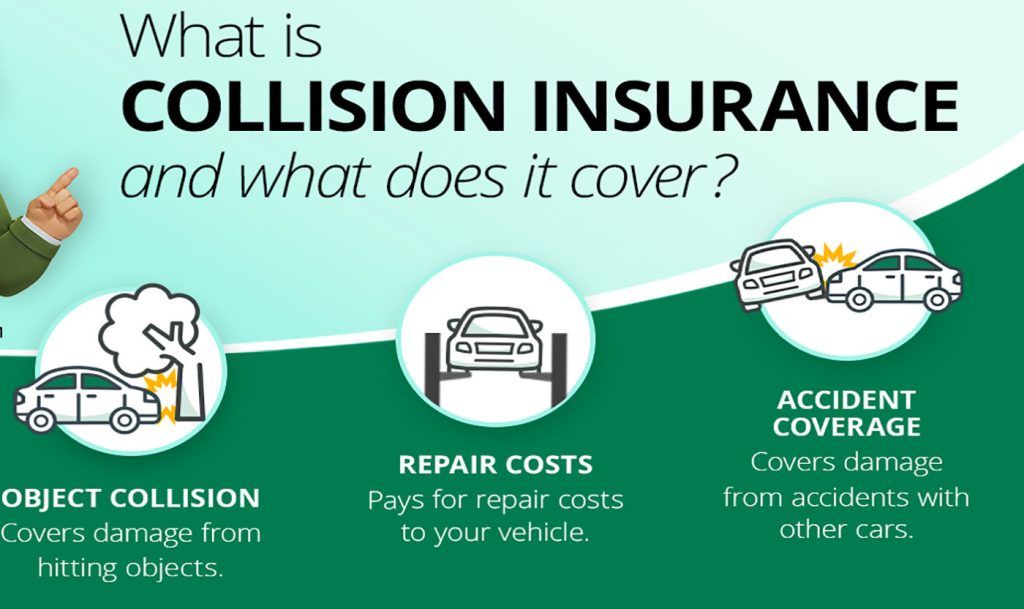

2. Collision Insurance: Coverage When You’re at Fault

Collision insurance specifically covers damage to your vehicle from accidents, regardless of who is at fault. This makes it particularly valuable if you have a newer car or a car with a significant resale value. It’s also often required by lenders if you’re financing your vehicle.

Collision insurance is straightforward: it repairs or replaces your car after an accident with another vehicle or object, like a lamppost or a guardrail. However, coverage is limited to the actual cash value (ACV) of your car, minus your deductible. That means for older cars, collision insurance might not always be cost-effective.

Scenario: Suppose you drive a car worth \$20,000 and have a \$1,000 deductible. You hit a pole, causing \$4,000 in damage. You would pay \$1,000 out of pocket, and your insurer covers the remaining \$3,000. However, if your car’s value is only \$1,500, collision insurance may cost more annually than the potential payout—something many drivers overlook.

3. Comprehensive Insurance: Guarding Against Non-Collision Damage

Comprehensive insurance covers damage not caused by a collision, often referred to as “other than collision.” This includes:

- Theft or vandalism

- Fire or natural disasters (storms, floods, earthquakes)

- Falling objects (trees, debris, etc.)

- Damage from hitting animals

Comprehensive coverage is essential for areas prone to harsh weather or high crime rates. While collision covers accidents, comprehensive protects against the unexpected. For instance, in Northern Europe, hail damage is a common occurrence, making comprehensive insurance indispensable for drivers there.

Tip: If your vehicle is relatively new or expensive, I always recommend pairing collision and comprehensive coverage for maximum protection. Again, NerdWallet provides a solid comparison platform to explore quotes across multiple insurers for both coverages.

4. Personal Injury Protection (PIP) and Medical Payments Coverage (MedPay)

These coverages differ slightly but both focus on medical expenses:

Personal Injury Protection (PIP): Sometimes called “no-fault insurance,” PIP covers medical costs for you and your passengers, regardless of fault. Depending on your state or country, it may also cover lost wages, rehabilitation, and funeral expenses.

MedPay: MedPay covers medical expenses for you and your passengers due to an accident, often paying health insurance copays or deductibles. Unlike PIP, MedPay typically doesn’t cover wage loss or funeral costs, and is often optional outside no-fault states.

In my research, I found that many drivers underestimate the value of PIP, especially in accidents with multiple injuries. It can prevent months of expensive medical bills from falling solely on your shoulders.

Resource: For detailed guidance on PIP and MedPay options, The Zebra offers a comprehensive breakdown by state and insurer.

5. Uninsured Motorist (UM) and Underinsured Motorist (UIM) Coverage

One in seven drivers in the U.S. doesn’t carry insurance, according to 2022 studies. This is where UM coverage becomes essential. It protects you if you’re hit by a driver who has no insurance. UIM coverage, on the other hand, kicks in when the at-fault driver’s insurance limits aren’t enough to cover your damages.

These coverages are crucial because they shield you from financial catastrophe. Imagine an accident caused by a driver with minimal insurance: hospital bills, car repairs, and lost income could easily exceed their coverage. UM and UIM provide the safety net you need.

Recommendation: Always check your state’s minimum required UM/UIM coverage. Even if not mandatory, it’s wise to maintain limits high enough to cover potential catastrophic damages.

6. Gap Insurance: Bridging the Loan-to-Value Gap

Gap insurance is particularly relevant for financed or leased vehicles. It covers the “gap” between what you owe on your car loan and your car’s current market value if your vehicle is totaled.

Example: Suppose you owe \$25,000 on your car, but after an accident, your insurer values it at \$20,000. Without gap insurance, you’d pay the \$5,000 difference. Gap insurance ensures you aren’t left paying for a car you no longer have.

In my experience advising drivers, gap insurance is one of the most overlooked policies, especially for new or leased vehicles. Lenders often encourage it, but many drivers fail to consider the financial risk if they skip it.

7. Optional Add-On Coverages

Beyond the core coverages, insurers offer optional add-ons for specific needs:

- Rental Reimbursement: Covers rental car costs while your vehicle is being repaired after a covered incident.

- Roadside Assistance: Provides towing, battery jumps, or flat tire help.

- New Car Replacement: Pays for a brand-new replacement vehicle if your new car is totaled, rather than its depreciated value.

- Glass Coverage: Covers windshield or window repairs/replacements.

- Mechanical Breakdown Coverage: Similar to an extended warranty for high-value repairs.

- Ride-Share Insurance: Covers gaps when driving for services like Uber or Lyft.

These add-ons can be lifesavers depending on your lifestyle. For instance, if you live in a rural area or drive frequently for work, roadside assistance and rental reimbursement are highly valuable.

8. Classic and Specialty Vehicle Insurance

Classic car insurance caters to antique or collectible vehicles, with policies often based on agreed value rather than market value. If you own a vintage car, this is crucial because standard insurance might not cover full restoration costs.

Specialty insurance also extends to vehicles used for business, modified cars, or vehicles with custom parts. Policies for these cars typically consider replacement costs of aftermarket modifications, which standard coverage might exclude.

Pro tip: For classic or modified cars, consider Hagerty or similar specialist insurers that understand the unique valuation and risk factors associated with these vehicles.

Choosing the Right Coverage: My Practical Advice

- Assess Your Vehicle Value: Older cars may not need collision or comprehensive coverage, while new or leased vehicles almost always do.

- Consider Your State or Country Requirements: Minimum liability levels vary, so confirm what’s legally required.

- Evaluate Risk Factors: Frequent drivers, urban residents, or those with long commutes may need higher coverage and additional add-ons.

- Shop Around: I strongly recommend comparing at least three quotes. NerdWallet and The Zebra make this process straightforward.

- Balance Deductibles and Premiums: Higher deductibles reduce premiums but increase out-of-pocket costs. Choose a balance that works with your budget.

- Look Beyond Price: Consider coverage limits, exclusions, and customer service reputation. Cheaper policies can be more expensive long-term if they don’t cover your needs.

Online Resources for 2025 Drivers

- NerdWallet (nerdwallet.com): Compare insurance rates and coverage options across U.S. insurers.

- The Zebra (thezebra.com): Provides side-by-side comparisons of auto insurance policies, including optional coverages.

- Hagerty (hagerty.com): Specialist insurance for classic, collectible, and high-value vehicles.

- CompareEurope (compareeurope.com): Offers comparisons of European car insurance providers for 2025 policies.

Navigating Auto Insurance in 2025

Car insurance in 2025 is no longer just about liability coverage; it’s a multi-layered ecosystem of policies, add-ons, and state-specific requirements. From liability and collision to specialty add-ons and gap insurance, the right mix protects not only your car but your financial future. I’ve seen countless drivers underestimate the cost of accidents, theft, or even natural damage, which is why I emphasize proactive planning and comparison.

Your coverage should reflect your risk tolerance, vehicle value, and lifestyle. Take advantage of online tools, licensed agents, and reputable comparison websites. Insurance is not just a legal obligation—it’s a critical financial strategy for anyone who drives. Make informed decisions now, and you’ll drive with confidence, knowing you’re fully protected against the unpredictable realities of life on the road.