In the ever-evolving world of investing, one key strategy that often gets overlooked by beginners and even some seasoned investors is industry rotation. In essence, industry rotation refers to the movement of investments from one sector or industry to another based on economic cycles, market trends, and investor sentiment. Understanding how and when to adjust your investments in response to these changes is a vital skill that can significantly enhance your portfolio’s returns.

As we navigate through 2025, it’s crucial to recognize how certain industries may thrive under different economic conditions and how market forces shape the performance of individual sectors. Whether you’re a conservative investor looking to minimize risk or an aggressive trader seeking the next big opportunity, adjusting your stock selections based on industry rotation can help you stay ahead of the curve.

In this article, we’ll explore how to analyze industry rotation, which sectors are likely to benefit from current market dynamics, and how to make informed decisions to adjust your investments accordingly. By the end, I’ll provide actionable tips and strategies to help you master industry rotation and make smart stock selections that align with the market’s changing tides.

What Is Industry Rotation?

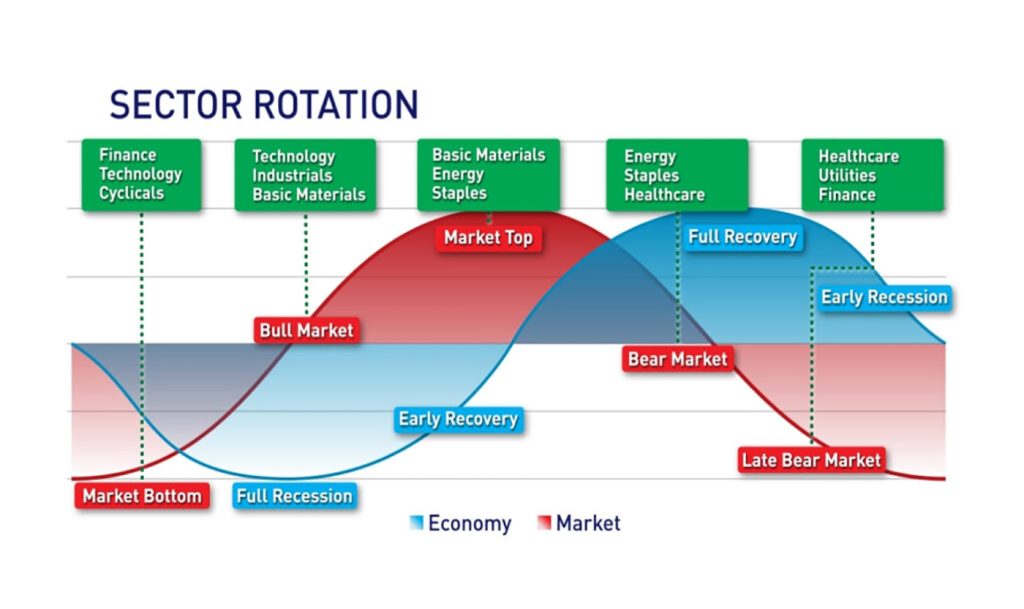

Industry rotation is essentially the strategy of shifting investment from one sector to another in response to market conditions, economic indicators, and broader investment trends. The underlying idea is that different sectors perform well at different points in the business cycle. For example, cyclical sectors like consumer discretionary and industrials tend to outperform when the economy is growing, while defensive sectors like utilities, healthcare, and consumer staples may provide stability during economic slowdowns or periods of market uncertainty.

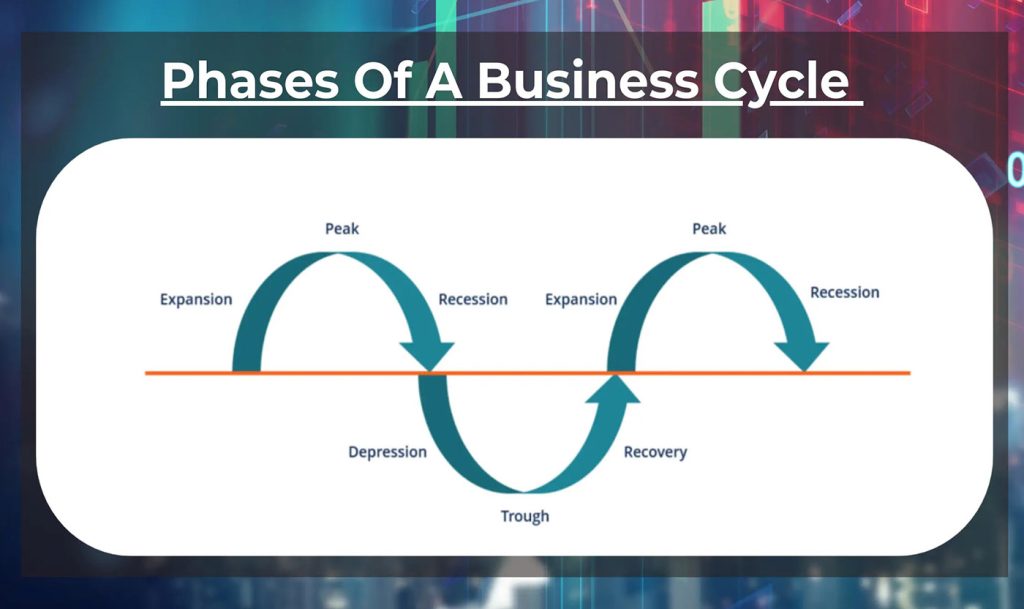

Understanding the phases of the business cycle and their impact on various sectors can help investors make timely decisions about where to allocate their capital. The business cycle typically moves through four stages: expansion, peak, contraction, and trough. Each phase offers opportunities and risks for different industries.

- Expansion: This is the phase of economic growth. Consumer spending is high, and businesses are investing heavily. Sectors like technology, consumer discretionary, and industrials tend to outperform.

- Peak: At this stage, the economy is at its maximum output, and growth begins to slow. Defensive sectors such as utilities, healthcare, and real estate start to perform better.

- Contraction: The economy begins to slow down. During recessions, defensive sectors and government bonds are more attractive as they offer stability and lower risk.

- Trough: This is the low point of the economic cycle, often preceding a recovery. Cyclical sectors and stocks with strong growth potential, like consumer discretionary and technology, start to perform well again as the economy begins to recover.

Recognizing Market Cycles and Sector Performance

One of the most critical skills an investor can develop is recognizing which phase of the business cycle we are in. The 2025 market is showing signs of mixed recovery as we emerge from the aftermath of global disruptions and shifts in monetary policies. So, how can you adapt your investments to take advantage of these transitions?

1. Cyclical Sectors: A Focus on Growth

When the economy is expanding, cyclical sectors tend to benefit. These include industries that rely heavily on consumer demand and economic activity, such as:

- Technology: The tech sector has been experiencing strong growth, especially with the rise of AI, blockchain, and quantum computing. As businesses continue to digitize, demand for tech products and services remains high.

- Consumer Discretionary: This includes industries such as retail, leisure, and luxury goods. Consumers are more likely to spend on non-essential items when they have more disposable income.

- Industrials: In periods of economic growth, infrastructure and construction industries often see a boom. Companies involved in manufacturing, transportation, and construction benefit from increased demand.

2. Defensive Sectors: Stability in Uncertainty

During periods of contraction or economic uncertainty, defensive sectors typically perform better. These sectors provide essential goods or services that people continue to purchase even in difficult economic times. Some of these sectors include:

- Healthcare: Healthcare is often seen as a recession-proof industry, with people always needing medical care. Pharmaceutical companies, biotechnology, and medical device manufacturers tend to do well even during downturns.

- Utilities: As a basic need, utility companies—providing water, electricity, and natural gas—remain stable regardless of the economic environment. These stocks are known for their consistent dividends and low volatility.

- Consumer Staples: Products like food, beverages, and household products are essential regardless of the economic climate. Companies like Procter & Gamble, Coca-Cola, and Unilever tend to outperform during downturns.

3. Energy and Commodities: Commodity Cycles

Commodity sectors such as energy and metals often exhibit their own cyclical behavior. The prices of oil, gas, and metals fluctuate based on supply and demand dynamics, geopolitics, and global trade. These sectors can present profitable opportunities for investors who understand the factors influencing commodity prices.

- Energy: If there is an uptick in global demand for energy or geopolitical tensions that disrupt supply, energy stocks may see significant growth. Conversely, periods of overproduction or reduced demand can lead to volatility in this sector.

- Metals and Mining: The mining sector often sees significant booms during times of high demand for industrial materials, particularly during periods of infrastructure growth.

How to Analyze Industry Rotation for Stock Selection

Now that we’ve covered the basic idea of industry rotation and how market cycles influence sector performance, let’s delve into how you can practically apply this knowledge when selecting stocks for your portfolio.

1. Monitor Economic Indicators

To predict shifts in the business cycle, keep an eye on key economic indicators, such as:

- GDP Growth: A strong GDP growth rate signals an expanding economy, which often benefits cyclical sectors.

- Unemployment Rates: Low unemployment generally signals economic growth and consumer confidence, which is positive for sectors like technology and consumer discretionary.

- Interest Rates: Rising interest rates can negatively impact growth stocks and cyclical sectors but may favor defensive stocks and bond investments.

Understanding these indicators will help you forecast the direction of the market and adjust your investments accordingly.

2. Use Sector ETFs for Easy Exposure

If you’re unsure about picking individual stocks within a particular sector, consider using sector ETFs. These exchange-traded funds track specific sectors, giving you broad exposure to the industry’s top companies without the need to pick individual stocks. Websites like Morningstar and ETF.com provide detailed reviews and performance metrics for these funds.

3. Evaluate Stock Valuations

Valuation is an essential aspect of stock selection. Even though an industry may be poised for growth, buying overpriced stocks can still lead to poor returns. Tools like Yahoo Finance and Seeking Alpha allow you to assess the price-to-earnings (P/E) ratios and other fundamental metrics of companies within your chosen sector.

4. Diversify Across Sectors

While industry rotation is a great strategy, it’s also essential to maintain a diversified portfolio. Don’t put all your eggs in one basket—especially if you’re pivoting between sectors that have different risk profiles. A good mix of cyclical and defensive stocks can help balance potential growth with stability, giving you a smoother ride through market fluctuations.

Practical Tips for Adjusting Your Investments

Here are a few practical tips to help you effectively adjust your investments based on market changes:

- Be Proactive, Not Reactive: Instead of waiting for the market to crash or peak, monitor economic indicators regularly to anticipate changes before they occur. This allows you to adjust your portfolio ahead of time, rather than after the fact.

- Stay Informed: Follow reliable sources for financial news and market analysis. Websites like CNBC, Bloomberg, and Reuters provide up-to-date information on the market and economic trends that can inform your investment decisions.

- Review Your Portfolio Regularly: Set aside time every quarter to review your investments. Rebalance your portfolio based on changing market conditions, whether it’s rotating into cyclical stocks or increasing exposure to defensive sectors.

- Avoid Panic Selling: During times of volatility, avoid making rash decisions. Stick to your long-term strategy and make adjustments slowly and thoughtfully.

- Use Stop-Loss Orders: To limit downside risk, consider using stop-loss orders on your stocks, especially in more volatile sectors. This will help you protect your investments in case of sharp market declines.

Adjusting your investments based on industry rotation is an essential strategy for managing your portfolio in 2025 and beyond. Understanding which sectors are likely to benefit from current market conditions and economic cycles will allow you to make informed decisions, minimizing risk and maximizing returns.

By staying vigilant and proactive, you can take advantage of market changes instead of being caught off guard. Whether you’re a seasoned investor or just starting, learning how to rotate your investments across industries will help you build a robust portfolio that can withstand the fluctuations of the market.

Good luck with your investing journey, and remember to always stay informed and diversified!