If you’ve been in the investment world for any amount of time, you’ve probably heard the phrase: “Don’t put all your eggs in one basket.” While it might seem like a simple piece of advice, the concept of diversification is the bedrock of any solid investment strategy, especially in a year like 2025, where markets are unpredictable and economic forces are constantly shifting.

For those of us investing in stocks, bonds, real estate, and even cryptocurrency, the landscape has become more complex. After the global disruptions from the pandemic, the emergence of AI technologies, and the growing importance of sustainability and renewable energy, the market dynamics are evolving at an unprecedented pace.

But how exactly can you reduce investment risk while simultaneously capturing the opportunities that these changing conditions present? The answer lies in thoughtful asset allocation—spreading your investments across different assets, sectors, and geographies. Proper allocation ensures that no single downturn can derail your long-term financial goals.

In this article, I’ll walk you through ten effective asset allocation strategies that can help mitigate risk, maximize potential returns, and help you sleep easy at night, knowing your portfolio is well-positioned to handle the ups and downs of the market.

1. The 60/40 Portfolio: A Foundation for Balanced Risk

The 60/40 portfolio—allocating 60% of your investments to stocks and 40% to bonds—is perhaps the most well-known strategy in the investment world. It’s a time-tested approach designed to strike a balance between growth and stability.

Why it Works:

- Growth Through Stocks: The 60% allocation to equities gives you exposure to the capital appreciation potential of the stock market. Over the long run, stocks tend to outperform other asset classes.

- Risk Mitigation with Bonds: The 40% bond allocation provides a safety net, especially during stock market downturns. Bonds typically perform better when equities struggle, and they provide a predictable income stream through interest payments.

In 2025, however, bond yields have been on the rise due to increasing interest rates. This means that bonds could continue to offer some shelter in volatile markets, but their traditional role as a safe haven might not be as strong as it once was. If you follow this strategy, it’s worth considering short-term bonds or inflation-protected securities (TIPS) as part of your bond allocation.

You can track bond and stock performance through platforms like Yahoo Finance and Morningstar, which provide up-to-date data on both asset classes.

2. The All-Equity Strategy: High Risk, High Reward

For those who prefer aggressive growth, the all-equity strategy involves investing entirely in stocks. This strategy is favored by risk-tolerant investors, especially those with long-term horizons.

Why it Works:

- Capital Appreciation: Stocks tend to outperform most other assets in the long run. With no bonds or safer assets to offset the risk, the potential for high returns is significantly greater.

- Market Cycles: During strong bull markets or periods of economic expansion, an all-equity portfolio can generate extraordinary returns.

However, it’s important to remember that this strategy also exposes you to significant market volatility. If the stock market experiences a major downturn, you might experience steep losses. Therefore, this strategy is more suitable for those who can afford to ride out the fluctuations and have a strong stomach for risk.

If you choose this route in 2025, focusing on sectors like technology, green energy, and biotech could be advantageous, as these areas are expected to see substantial growth in the coming years.

3. The Global Diversification Strategy: Spread Your Investments Across the Globe

Investing solely in your home country’s stock market can expose you to risks associated with local political, economic, or currency fluctuations. By diversifying your investments globally, you can reduce the impact of country-specific risks and benefit from growth in different regions.

Why it Works:

- Geographical Risk Reduction: Different countries’ economies behave in different ways. A crisis in one part of the world may not affect another, and emerging markets can provide growth opportunities that developed countries cannot.

- Access to Global Growth: By investing in regions such as Asia, Latin America, and Europe, you can capitalize on sectors or economies that are growing faster than your local market.

In 2025, the emerging markets in Asia and the African continent could be ripe for investment, especially in industries like renewable energy and tech innovation. You can gain exposure to international markets through ETFs or mutual funds that target specific regions.

Websites like ETF.com and Global X ETFs can be useful resources for identifying global investment opportunities.

4. Tactical Asset Allocation (TAA): Adjusting for Market Conditions

Unlike strategic asset allocation, where the portfolio is designed for long-term stability and set at regular intervals, Tactical Asset Allocation (TAA) involves actively adjusting your portfolio in response to short-term market conditions.

Why it Works:

- Capitalizing on Market Movements: By making adjustments based on market conditions, you can increase exposure to certain assets or sectors that are expected to outperform.

- Flexibility: TAA allows you to take advantage of current economic trends, whether that means shifting towards tech stocks when they are in favor or moving into bonds during periods of market volatility.

In 2025, TAA might involve shifting funds into sectors such as AI, clean energy, or healthcare, all of which are likely to see growth. However, it’s important to be cautious and avoid overtrading, as this can increase transaction costs and expose you to unnecessary risks.

For more information on short-term market movements and sector performance, Bloomberg and The Wall Street Journal are excellent resources to track real-time data.

5. Sector Rotation Strategy: Moving With the Market Cycle

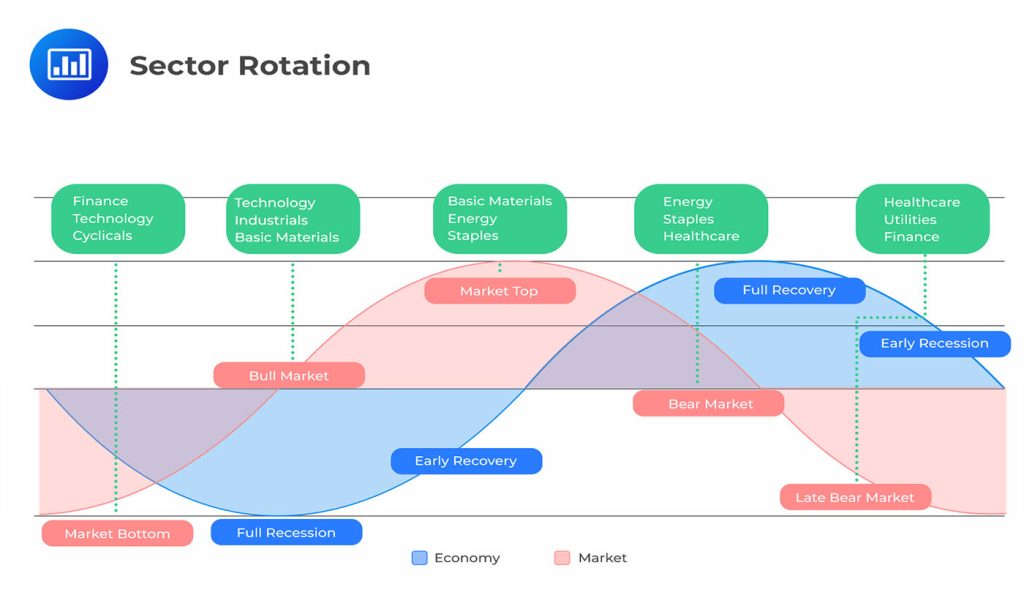

Sector rotation involves shifting investments between different sectors of the economy, based on the current stage of the economic cycle. For example, cyclical stocks like consumer discretionary and industrial stocks tend to outperform during periods of economic expansion, while defensive stocks like utilities and consumer staples do better during slowdowns or recessions.

Why it Works:

- Cyclical Performance: By rotating into the right sectors at the right time, you can maximize returns by taking advantage of sector performance throughout the business cycle.

- Reduced Risk: If one sector underperforms, others may offset those losses, helping stabilize your overall portfolio.

In 2025, you might rotate out of technology stocks that have experienced explosive growth in recent years and into energy stocks or real estate investment trusts (REITs), especially with the ongoing interest in sustainable energy and infrastructure development.

Sites like MarketWatch and Seeking Alpha provide in-depth analysis on sector performance, making them excellent tools for sector rotation strategies.

6. The Dividend Growth Strategy: Focus on Steady Income

For those looking for a more stable income stream, the dividend growth strategy focuses on companies that regularly increase their dividend payouts. These companies are usually well-established with strong cash flows and a commitment to rewarding shareholders.

Why it Works:

- Consistent Income: Dividends provide a predictable income stream, which can be reinvested to compound returns.

- Stability: Dividend growth stocks tend to be blue-chip companies that have weathered many economic cycles and are less volatile than high-growth stocks.

In 2025, sectors like utilities, consumer staples, and telecommunications could provide good opportunities for dividend growth investing. Look at companies like Coca-Cola or AT&T for reliable dividend increases over time.

7. The Real Estate Strategy: Tangible Assets for Stability

Real estate offers investors an opportunity to add a tangible asset to their portfolio that typically appreciates over time. Additionally, real estate investment trusts (REITs) allow investors to gain exposure to property markets without having to physically buy and manage properties.

Why it Works:

- Hedge Against Inflation: Real estate tends to perform well during periods of inflation, as property values and rents increase.

- Income Generation: REITs provide steady dividends, and direct property investments generate rental income, making them attractive for income-focused investors.

In 2025, consider investing in REITs focused on commercial properties or residential real estate in growing urban areas. Websites like Zillow and Realty Income are great places to track real estate performance and find opportunities.

8. Alternative Investments: Unlocking Non-Traditional Assets

Alternative investments like cryptocurrencies, commodities, and private equity offer exposure to non-traditional asset classes that often have low correlation with stocks and bonds. These assets can provide diversification and risk reduction, especially during times of market turbulence.

Why it Works:

Diversification: Alternative assets typically have a low correlation with traditional stocks and bonds, meaning they don’t move in the same direction as traditional investments.

Potential for High Returns: Some alternative assets, like cryptocurrencies or gold, can deliver outsized returns, especially during periods of uncertainty.

While alternatives can be volatile, incorporating them into your portfolio—perhaps in the form of a small allocation—can enhance overall diversification.

9. The Target-Date Fund Strategy: A Hands-Off Approach

For investors who don’t want to actively manage their portfolios, a target-date fund (TDF) offers a simple solution. TDFs automatically adjust your asset allocation based on a target retirement date, becoming more conservative as the date approaches.

Why it Works:

- Set-and-Forget: TDFs provide a low-maintenance investment solution for those saving for retirement or other long-term goals.

- Automatic Risk Reduction: The fund automatically shifts from high-risk assets (like stocks) to safer assets (like bonds) as the target date nears.

10. The Dollar-Cost Averaging (DCA) Strategy: Lowering Entry Risk

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market’s condition. Over time, this method helps you avoid trying to time the market and reduces the risk of investing a lump sum when prices are high.

Why it Works:

- Mitigates Market Timing Risk: By spreading your investment over time, you’re less likely to buy at the wrong time.

- Smoother Returns: DCA often leads to a smoother investment experience and can reduce the emotional stress of large market swings.

Tailoring Your Strategy for 2025 and Beyond

Effective diversification is about spreading your investments across various asset classes and strategies that align with your financial goals and risk tolerance. Each of the strategies outlined here offers a different approach to managing risk and maximizing returns, but they all share one fundamental principle: don’t put all your eggs in one basket.

As we move into 2025, be sure to stay informed by following resources like Seeking Alpha, Yahoo Finance, and Morningstar. These platforms provide regular updates on market trends, asset performance, and economic news that can help guide your decisions. With careful planning, you can navigate the complexities of the modern investment landscape and build a portfolio that stands the test of time.