As we step into 2024, the landscape of investing is more dynamic than ever. The economy is constantly shifting, new investment opportunities are emerging, and financial markets remain as volatile as ever. Amidst all of this, one key element remains unchanged: the importance of having a clear, actionable investment plan. A well-thought-out financial strategy not only helps you navigate uncertainties but also ensures that you are building wealth in a disciplined, consistent manner.

Creating and sticking to an annual investment plan can seem daunting, especially for those just starting or those who have struggled with financial discipline in the past. But rest assured, with the right tools, knowledge, and approach, it is entirely achievable. In this article, I’ll walk you through how to create an effective annual investment plan, set clear goals, track your progress, and, most importantly, ensure that you stick to your strategy year after year.

1. Why Every Investor Needs an Annual Investment Plan

At first glance, an investment plan might seem like an unnecessary step—especially if you’re someone who prefers to be reactive to market movements or invest based on gut instinct. However, what I’ve learned over the years is that investing without a plan is like driving without a map. You might get somewhere, but it’s likely not where you want to be, and the journey will be full of unnecessary detours.

An annual investment plan provides you with a roadmap for your financial goals. It defines your objectives, outlines the steps you need to take to reach them, and gives you the flexibility to adapt to changes as you move forward. It also helps you keep emotions in check, avoid impulsive decisions, and maintain a long-term perspective.

2. Setting Clear, Measurable Goals

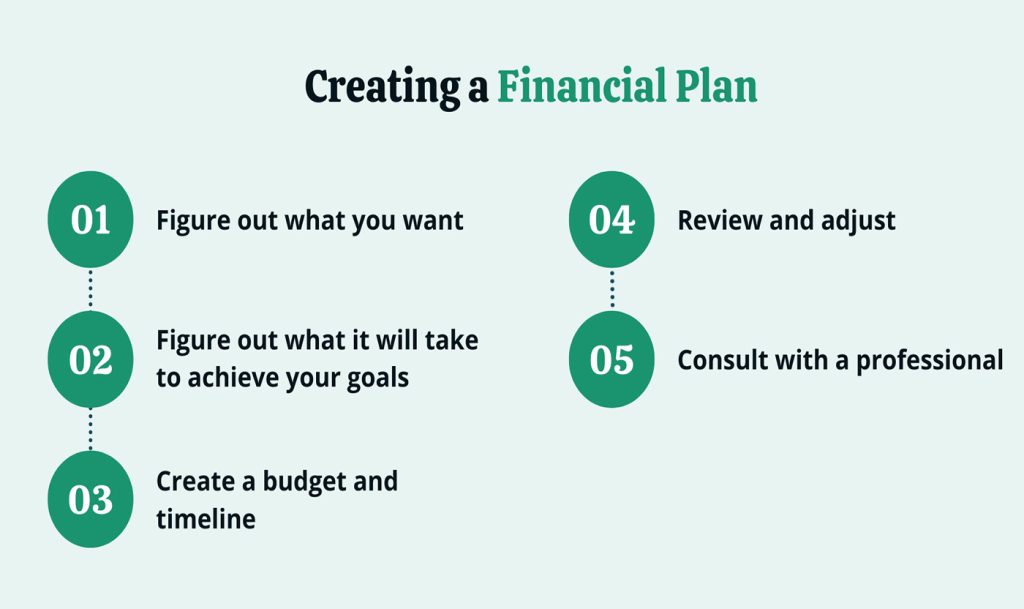

The first step in creating a successful investment plan is setting clear, measurable goals. Without goals, it’s easy to lose track of what you’re trying to achieve and become distracted by market fluctuations.

Start by asking yourself a few fundamental questions:

- What am I investing for? Are you saving for retirement, buying a house, funding a child’s education, or building wealth for financial freedom?

- What is my time horizon? When do you need the money? The length of time you plan to invest will significantly affect your asset allocation and risk tolerance.

- What is my risk tolerance? How much volatility can you comfortably handle? Understanding your risk tolerance is crucial in choosing the right mix of investments.

3. Understanding Your Financial Situation

Before you start crafting your investment plan, you need to have a solid understanding of your current financial situation. This means reviewing your income, expenses, savings, debt, and any other financial obligations.

- Review your cash flow: Take a close look at your monthly income and expenses. Are you living within your means? Can you increase your savings rate? I recommend using budgeting apps like Mint or YNAB (You Need A Budget) to track your expenses and identify areas where you can cut back and redirect funds toward investments.

- Analyze your debt: High-interest debt, like credit cards, can be a major obstacle to wealth building. Before diving into the stock market, consider paying down high-interest debts first. If you’re dealing with student loans, mortgages, or car payments, ensure you factor these into your budget.

- Establish an emergency fund: It’s essential to have cash reserves in case of unforeseen circumstances. An emergency fund should cover at least 3-6 months’ worth of living expenses. This provides you with the flexibility to weather market downturns without needing to sell investments prematurely.

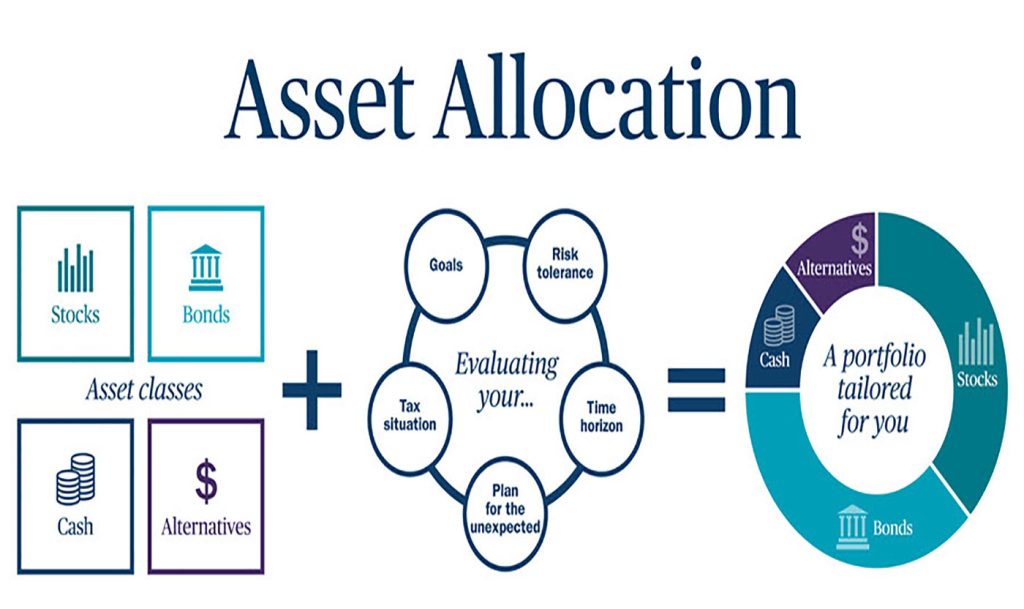

4. Deciding on Your Asset Allocation

Now that you have your goals and financial situation in mind, it’s time to decide how to allocate your assets. Asset allocation refers to how you divide your investments across different asset classes, such as stocks, bonds, and cash. Your asset allocation should align with your risk tolerance and time horizon.

For example:

- If you’re younger and have a long-term time horizon, you may be comfortable with a higher percentage of stocks (which carry more risk but offer higher potential returns) and a smaller percentage in bonds or cash.

- If you’re closer to retirement or need the funds in the short-term, you may choose to allocate more to bonds and cash, which are more stable but offer lower returns.

One of the most important pieces of advice I can offer is to diversify your investments. This means spreading your money across different sectors, geographic regions, and asset classes. Diversification reduces the risk of your entire portfolio being affected by the poor performance of a single investment.

A great tool for deciding on asset allocation is Vanguard’s Asset Allocation Model Portfolios, which can help you identify the right balance for your needs based on your age, risk tolerance, and goals.

Check out Vanguard here: www.vanguard.com

5. Choosing the Right Investment Vehicles

Once you’ve decided on your asset allocation, the next step is to select the right investment vehicles to implement your strategy. This could include:

- Individual stocks: Direct investments in specific companies. Stocks offer high potential for returns but come with higher volatility.

- Exchange-traded funds (ETFs): ETFs are a great way to diversify your portfolio without having to pick individual stocks. They are funds that hold a basket of stocks or other assets. Some popular ETFs include SPY (S&P 500 ETF) and VTI (Total Stock Market ETF).

- Mutual funds: Like ETFs, mutual funds pool money from investors to buy a diversified portfolio of stocks or bonds. However, mutual funds are actively managed, meaning fund managers make decisions on behalf of the investors.

- Robo-advisors: If you’re looking for a hands-off approach to investing, robo-advisors like Betterment and Wealthfront use algorithms to create and manage your portfolio based on your risk tolerance and financial goals.

Check out Betterment here: www.betterment.com

6. Creating a Monthly Investment Strategy

Now that your plan is in place, it’s important to commit to regular contributions. Many investors set up automated monthly contributions to their investment accounts, making the process less daunting and ensuring consistent investing. I recommend setting up automatic transfers from your checking account to your investment accounts each month, even if it’s a small amount. Consistency is key!

This also brings us to the concept of dollar-cost averaging (DCA), a strategy where you invest a fixed amount of money at regular intervals, regardless of the market’s performance. DCA can help mitigate the risk of market timing and smooth out market volatility.

Additionally, rebalancing is an important part of this monthly routine. Over time, your asset allocation might drift as certain investments perform better than others. Rebalancing involves adjusting your portfolio to restore the original allocation percentages. This ensures that your risk profile remains aligned with your goals.

7. Staying Disciplined: Avoiding Common Pitfalls

Staying disciplined throughout the year is the biggest challenge for many investors. There are a few common pitfalls that can derail an investment plan:

- Emotional investing: Fear and greed can lead to rash decisions. During market downturns, it’s tempting to sell off investments to avoid further losses, but this often leads to locking in losses. Similarly, when the market is booming, it’s easy to get caught up in the hype and take on more risk than you’re comfortable with. To combat this, try to adopt a long-term mindset. Set your plan and stick to it, remembering that investing is about consistency, not perfection.

- Chasing trends: While it’s tempting to follow the latest hot stock or trendy investment, such as meme stocks or speculative assets like cryptocurrency, doing so without a clear strategy can lead to disappointment. Stick to your plan, even when the latest trends seem enticing.

- Not reviewing the plan regularly: Life changes, and so do financial markets. It’s important to review your investment plan annually to ensure that it still aligns with your goals, risk tolerance, and financial situation.

8. Tracking Your Progress

One of the most important steps in executing your investment plan is tracking your progress. Regularly reviewing your investments allows you to adjust your strategy if necessary, identify any shortcomings, and celebrate the progress you’ve made.

Use platforms like Personal Capital or Mint to track your net worth and investment growth. These tools can aggregate your financial accounts and give you a holistic view of your financial health.

Check out Personal Capital here: www.personalcapital.com

9. Adapting to Market Changes

While you should have a clear plan in place, flexibility is essential. The market, as we all know, is unpredictable. External factors like interest rate changes, economic downturns, or even political instability can have a significant impact on your portfolio. It’s crucial to have the ability to adapt to these changes while maintaining your overall strategy.

When the market dips, for instance, it’s easy to feel the urge to sell and minimize losses. But rather than react impulsively, consider how such a dip fits into your long-term goals. If you’re investing for retirement in 20+ years, a temporary market correction is unlikely to derail your strategy.

10. Committing to Your Financial Future

Creating and sticking to an annual investment plan is one of the best ways to ensure your financial success. While the journey may not always be smooth, having a structured approach to investing allows you to make informed decisions, stay disciplined, and ultimately build wealth over time.

By setting clear goals, understanding your finances, choosing the right assets, and consistently investing, you’ll be well on your way to achieving your financial objectives.

So, as you plan for 2024 and beyond, remember that investment success doesn’t come from following the latest trends—it comes from having a plan, sticking to it, and staying disciplined over time.