In today’s rapidly changing world, financial security is more important than ever. The idea of accumulating wealth can seem like a daunting challenge, but there’s a tried-and-true strategy that stands the test of time: long-term investing. This approach focuses on the steady, compounding growth of your investments over an extended period, typically years or even decades, rather than trying to make quick profits from short-term market movements.

As we approach 2024, the financial landscape continues to evolve, shaped by everything from technological advancements to global economic shifts. Yet, long-term investing remains one of the most reliable paths to wealth accumulation. In this article, I’ll break down how long-term investing works, the benefits it offers, and how you can begin paving the road to financial independence.

1. What is Long-Term Investing?

At its core, long-term investing is about taking a patient, strategic approach to investing in assets that are likely to appreciate over time. The aim isn’t to capitalize on short-term market swings but to position yourself for sustained growth by choosing investments that align with your financial goals and risk tolerance.

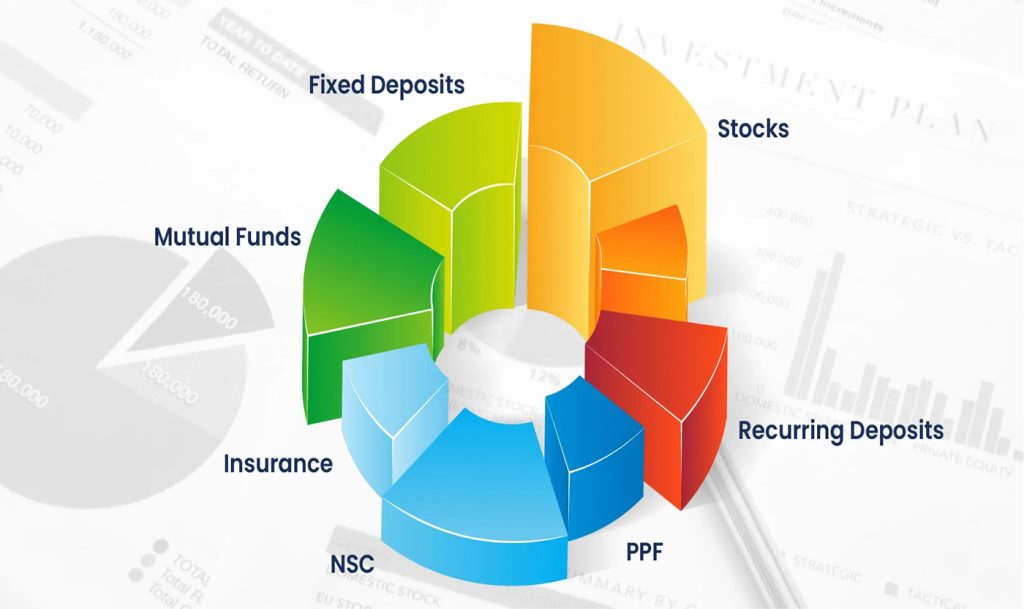

Long-term investments often include stocks, bonds, real estate, and mutual funds—assets that can generate returns over several years. The key is not just the asset itself but the mindset behind it: buy and hold.

Why is long-term investing effective?

The primary advantage of long-term investing is the power of compound growth. This is where your returns begin to generate additional returns. Over time, this compounding effect can result in significant wealth accumulation, especially when you start investing early and allow your investments to grow for decades.

2. Why Choose Long-Term Investing?

In an era dominated by volatile markets, economic uncertainties, and instant gratification, long-term investing offers a sense of stability and purpose. It allows investors to step back from the short-term noise and focus on sustainable wealth creation. Let’s explore the key benefits of long-term investing.

A. Reduced Risk of Market Volatility

Markets are unpredictable in the short term. You’ve probably seen news stories about stocks dropping 10% in a single day or bond yields fluctuating wildly. However, over the long run, the tendency for markets is to grow in value, as economies expand and companies innovate. By holding your investments for years or decades, you give your portfolio the opportunity to weather short-term market downturns and benefit from the market’s natural upward trend.

B. Lower Stress and Greater Peace of Mind

One of the most valuable aspects of long-term investing is that it removes much of the emotional turmoil often associated with investing. Instead of obsessing over day-to-day market movements, you can focus on the bigger picture. With long-term investing, you’re not making decisions based on short-term gains but rather on the solid, long-term fundamentals of the companies and assets you’re invested in. This leads to less stress and a better overall experience in the market.

C. Maximizing Compounding Returns

Compound interest is often called the “eighth wonder of the world,” and for good reason. It’s one of the most powerful tools for building wealth. When you reinvest your earnings (whether they’re dividends, interest, or capital gains), those earnings begin to generate returns of their own. This snowball effect can lead to exponential growth over time.

For instance, if you invest in a stock that provides a 7% annual return, your investment would double roughly every ten years. But that doubling happens not only because of your initial investment but also because of the compounded returns over time.

D. Tax Efficiency

In many countries, including the U.S., long-term investments tend to receive more favorable tax treatment compared to short-term trades. For example, in the U.S., long-term capital gains (for investments held over a year) are taxed at a lower rate than short-term gains. This makes long-term investing an effective way to grow wealth while minimizing tax liabilities.

3. How to Start Long-Term Investing

The idea of building wealth over time can seem overwhelming, especially when you’re just getting started. But the good news is that it doesn’t require large sums of money to start investing. In fact, the earlier you begin, the more time you’ll have to let your investments grow.

A. Define Your Financial Goals

Before diving into long-term investing, it’s essential to define your financial goals. These goals could be anything from saving for retirement to buying a home or even funding a child’s education. Understanding your goals will guide your investment strategy and help you determine your time horizon and risk tolerance.

For example, if your goal is retirement and you’re 30 years old, you may have a 30- to 40-year investment horizon, giving you plenty of time to recover from any short-term volatility. On the other hand, if you’re planning to buy a house in 5 years, you may want to take a more conservative approach to investing, focusing on lower-risk assets.

B. Choose the Right Investment Vehicles

The next step is selecting the right investments. Depending on your financial goals, you may choose to invest in:

- Stocks: Stocks represent ownership in companies and can offer significant returns over the long term. If you’re comfortable with a higher level of risk, individual stocks or stock-based exchange-traded funds (ETFs) could be an ideal choice.

- Bonds: If you’re looking for a more conservative option, bonds can be a good choice. Bonds pay interest over time and can be less volatile than stocks.

- Real Estate: Investing in real estate provides a tangible asset that can appreciate over time and offer rental income. However, real estate requires more hands-on management and can be less liquid than stocks or bonds.

- Mutual Funds and ETFs: For those who want to diversify without picking individual stocks, mutual funds and ETFs are great options. These funds pool investors’ money to invest in a broad range of stocks, bonds, or other assets, spreading out the risk.

C. Dollar-Cost Averaging (DCA)

One of the most effective strategies for long-term investing is dollar-cost averaging (DCA). This strategy involves investing a fixed amount of money into a particular asset (such as a stock or ETF) at regular intervals, regardless of the price. Over time, DCA reduces the impact of market fluctuations, allowing you to buy more shares when prices are low and fewer shares when prices are high.

The key to DCA is consistency. Whether the market is up or down, you continue investing at regular intervals. Over time, this approach has proven to be successful in helping investors build wealth steadily without trying to time the market.

D. Reinvest Dividends

If you’re investing in dividend-paying stocks or ETFs, it’s wise to reinvest your dividends rather than cashing them out. By doing this, you’re effectively increasing your position in the stock over time. This can significantly amplify your returns, especially when compounded over many years.

E. Stay Disciplined and Avoid Emotional Decisions

One of the hardest parts of long-term investing is maintaining discipline, especially when the market takes a downturn. The key to success in long-term investing is sticking to your strategy and not panicking when the market fluctuates. Remember, you’re investing for the long haul, not for short-term gains. Emotional decisions—like selling during a market dip—can undermine your long-term success.

4. The Importance of Patience

In the world of investing, patience is your best friend. Long-term investing requires a level of trust that the market will reward you for staying invested over the years. It can be difficult to watch markets dip and rise, but the key to wealth accumulation is to stay the course and allow your investments to grow over time.

It’s easy to get distracted by the noise of daily market fluctuations or to feel like you need to jump on the latest trends. But long-term success is built on staying focused on your goals, sticking to your investment plan, and allowing your wealth to grow at its own pace.

5. Useful Resources for Long-Term Investors

As you embark on your long-term investing journey, there are several resources that can help you stay informed and make better decisions:

- Investopedia (www.investopedia.com): A great resource for understanding investment concepts and terminology.

- Morningstar (www.morningstar.com): Offers in-depth analysis and ratings on stocks, mutual funds, and ETFs.

- Yahoo Finance (www.finance.yahoo.com): Provides news, data, and tools for tracking and analyzing investments.

- NerdWallet (www.nerdwallet.com): Offers financial advice and tools for budgeting, investing, and managing personal finance.

6. The Power of Long-Term Investing

Long-term investing is one of the most powerful strategies for building wealth over time. By staying disciplined, focusing on your financial goals, and allowing your investments to grow through compounding, you can pave the way for a financially secure future. The key is starting early, sticking to your plan, and having patience—trusting that, over time, your wealth will grow.

In the ever-evolving world of investing, long-term investing remains a tried-and-true approach that can stand the test of time. So, take that first step today and let your investments work for you in the years to come.

May you build wealth for a prosperous future!