Navigating the world of investing can often feel like trying to find your way through a dense forest—there are countless paths, each promising different outcomes, and you may not always know which one will lead you to your desired destination. The financial markets are no different, especially in 2024 when volatility, uncertainty, and an ever-changing economic landscape define the investment environment. With so many strategies available, how do you find the investment style that works best for you?

The key to successfully investing in today’s market is discovering your own investment style. Whether you’re an experienced investor or just getting started, understanding your preferences, risk tolerance, financial goals, and available time for managing investments is essential. Your investment style not only determines how you allocate capital but also how much time you dedicate to managing your portfolio and how you respond to market fluctuations.

In this article, I’ll walk you through the process of finding your investment style, explaining the different styles that exist, and providing actionable insights that can help you choose the right one for your personal financial situation. Let’s explore the world of investment strategies and how to match them with your goals.

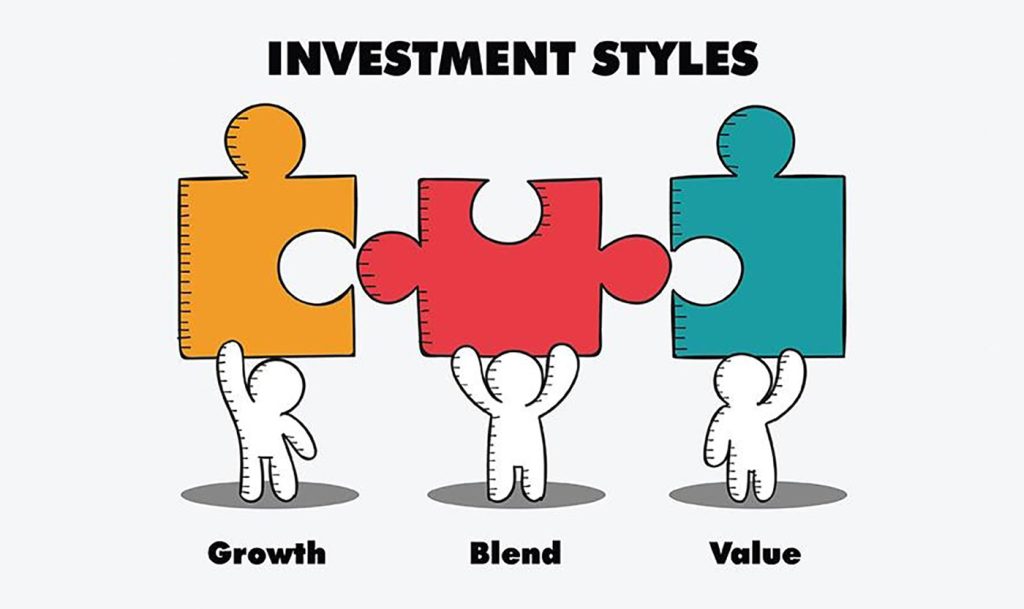

1. Understanding Investment Styles: A Starting Point

Before we dive into the specifics, it’s crucial to understand what “investment style” really means. At its core, an investment style refers to the approach an investor uses to make investment decisions. It encompasses everything from the type of assets you invest in, to how actively you manage your portfolio, and how much risk you’re willing to take on.

Several common investment styles include:

a. Value Investing

Value investing is an approach popularized by investors like Warren Buffett. The idea behind value investing is to buy undervalued stocks that the market has priced too low, based on their intrinsic value. Value investors believe that the market will eventually recognize these stocks’ true worth, leading to long-term price appreciation.

This style generally appeals to investors who have patience, a long-term outlook, and a willingness to analyze financial statements to identify undervalued companies.

b. Growth Investing

Growth investing, on the other hand, focuses on investing in companies that have strong potential for future growth. Growth investors look for companies that are expected to grow faster than their competitors or the market as a whole. These companies often reinvest their profits to expand, rather than paying dividends.

This approach appeals to those willing to take on more risk in the hope of higher returns, often focusing on industries like technology or biotechnology.

c. Dividend Investing

Dividend investing is focused on generating income through dividends paid by companies. Investors who prefer this strategy typically seek stable, well-established companies with a long history of paying dividends. This style is attractive to those who want a steady income stream, particularly in retirement.

d. Index Investing

Index investing is a passive investment style in which you invest in a market index, such as the S&P 500, rather than picking individual stocks. By doing this, investors aim to match the performance of the market, rather than trying to beat it. This style appeals to those who prefer a hands-off approach with a focus on long-term growth, and it generally involves lower costs.

e. Active Investing

Active investing involves actively managing a portfolio by buying and selling securities with the goal of outperforming the market. This style is typically adopted by experienced investors or professional fund managers who closely monitor market trends and economic factors to make informed decisions.

This approach requires a lot of time, effort, and research, but it offers the potential for higher returns compared to passive strategies.

f. Socially Responsible and ESG Investing

In recent years, socially responsible investing (SRI) and environmental, social, and governance (ESG) investing have gained popularity. This strategy involves choosing investments based on their alignment with personal values, such as sustainability, ethical labor practices, and corporate responsibility. It appeals to investors who want their money to make a positive impact on society while still generating financial returns.

2. Assessing Your Personal Financial Situation

Once you understand the various investment styles, the next step is to assess your own financial situation, goals, and risk tolerance. Your investment style should reflect who you are as an investor—your preferences, your capacity for risk, and the amount of time you are willing to dedicate to managing your investments.

a. Risk Tolerance

Risk tolerance is one of the most important factors in determining your investment style. It essentially refers to how much risk you are willing to take on in pursuit of returns. For example, if you are risk-averse, you might prefer more conservative investments such as bonds or dividend stocks. On the other hand, if you’re comfortable with volatility, you may lean toward growth stocks or even cryptocurrencies.

It’s essential to accurately assess your risk tolerance to avoid making investment choices that could lead to unnecessary stress or losses. A common method for assessing risk tolerance is through a questionnaire or risk tolerance assessment, which you can find on most investment platforms or financial advisor websites like Morningstar or NerdWallet.

b. Time Horizon

Your time horizon—the amount of time you have to invest before you need to access your money—also plays a critical role in choosing your investment style. For example, if you’re saving for retirement 20 years down the road, you can afford to take on more risk and focus on growth-oriented investments. However, if you’re looking to buy a house in the next couple of years, you’ll likely want a more conservative approach with less volatility.

c. Financial Goals

Consider your long-term and short-term financial goals. Are you aiming for a comfortable retirement, buying a home, or funding your children’s education? The answers to these questions can help shape your investment strategy. For instance, if you’re investing for retirement, a mix of stocks, bonds, and ETFs could provide long-term growth and stability. If you’re investing for a short-term goal, you might prioritize liquid assets like cash or low-risk bonds.

3. Finding Your Investment Style

Now that you’ve assessed your risk tolerance, time horizon, and financial goals, it’s time to begin finding your investment style. Here are some actionable steps to help you:

a. Start Small and Experiment

If you’re unsure of which style suits you best, start with a small, diversified portfolio and experiment with different approaches. This could include a mix of value stocks, growth stocks, and dividend-paying companies. By experimenting, you can gauge how comfortable you are with different types of investments.

One of the easiest ways to do this is through platforms like M1 Finance, where you can build a customized portfolio (called a “pie”) with different asset classes and sectors. This will allow you to test various strategies without risking too much capital.

b. Diversify Your Portfolio

Diversification is key to mitigating risk and achieving steady returns. Even if you prefer one particular investment style, it’s important to diversify your portfolio by including assets that align with other styles. For example, if you’re a growth investor, consider adding dividend-paying stocks to your portfolio to balance potential risk with income.

c. Use Technology to Your Advantage

In 2024, technology has made it easier than ever to find and refine your investment style. Apps like Personal Capital and Robinhood provide user-friendly interfaces that allow you to track your investments and make informed decisions. These tools also offer portfolio analysis features, which can give you insight into how well your investments are performing and help you make adjustments as needed.

Many of these platforms also offer educational resources that can help you learn about different investment strategies and how they align with your financial goals.

d. Consult a Financial Advisor

If you’re still unsure which investment style is right for you, consider consulting with a financial advisor. An advisor can help you assess your goals, risk tolerance, and time horizon to create a tailored investment strategy. Many advisory services, like Vanguard Personal Advisor Services or Fidelity, offer both robo-advisors and human advisors who can provide personalized guidance.

e. Be Patient and Stay Flexible

Finding your investment style is not something that happens overnight. It takes time to learn what works for you and adjust your strategy as needed. The market is constantly evolving, and so should your approach to investing. Stay flexible and open to learning as you progress on your investment journey.

4. Tips for Long-Term Investment Success

Once you’ve identified an investment style that suits you, it’s important to stick with it while remaining flexible enough to adapt to changing circumstances. Here are some additional tips for long-term investment success:

a. Review Your Portfolio Regularly

Markets change, and so will your personal circumstances. Be sure to review your portfolio regularly—at least once a year—to ensure that it aligns with your goals and risk tolerance. Adjust your portfolio as necessary based on shifts in the market or your own financial situation.

b. Focus on Long-Term Goals

Successful investing requires patience. Don’t be swayed by short-term market fluctuations or day-to-day news. Focus on the long-term, and allow your investments to grow over time. Trust in your strategy, and remember that compounding works best when you give it time to do its magic.

c. Keep Learning

The financial world is vast, and there’s always something new to learn. Stay informed about market trends, new investment opportunities, and strategies that can help you achieve your goals. Websites like Investopedia and The Motley Fool offer excellent educational resources to help you stay ahead.

d. Stay Disciplined

One of the most important traits of successful investors is discipline. Stick to your investment strategy, avoid emotional decision-making, and don’t let fear or greed drive your choices. The market will go up and down, but your discipline will help you stay on course.

Your Path to Investment Success

Finding your investment style is a process of self-discovery. It requires understanding your risk tolerance, goals, and the amount of time you can commit to managing your investments. Whether you prefer the steady income of dividend investing, the growth potential of stocks, or the simplicity of index investing, there’s a strategy that aligns with your values and financial aspirations.

By experimenting, staying disciplined, and using the right tools, you can build a portfolio that works for you and helps you navigate the complexities of the market. Keep learning, stay patient, and let your investments reflect your personal financial goals and risk tolerance.