The journey to financial freedom is a path many dream of but few truly understand how to navigate. At its core, financial freedom is the ability to live life on your own terms without the constant worry of running out of money. Achieving this freedom requires not only earning an income but also making smart decisions about how to manage, invest, and grow that money.

In 2024, the financial landscape is more complex than ever, with rapid advancements in technology, new investment opportunities, global economic shifts, and an ever-changing market environment. One of the most reliable ways to ensure long-term wealth accumulation and ultimately reach financial freedom is through building and optimizing a well-balanced investment portfolio.

This article will walk you through the essential steps of constructing an investment portfolio, optimizing it for long-term growth, and managing risk along the way. By the end, you should have a clear understanding of how to make informed decisions that will set you on the path toward financial freedom.

1. Understanding the Basics of an Investment Portfolio

Before diving into the intricacies of portfolio construction, it’s essential to understand what an investment portfolio is. At its most basic level, an investment portfolio is a collection of assets—such as stocks, bonds, real estate, or commodities—that an investor holds in order to achieve financial objectives.

The goal of an investment portfolio is not only to generate returns but also to balance risk and reward according to the investor’s unique financial goals, risk tolerance, and time horizon. The ideal portfolio should be diversified across different asset classes to minimize risk while ensuring steady growth over time.

In 2024, with the rise of new asset classes like cryptocurrencies and ESG (Environmental, Social, and Governance) investments, it’s more important than ever to be intentional about the assets you choose and how you allocate them.

2. Key Principles of Portfolio Construction

Constructing a portfolio is not a one-size-fits-all process. What works for one investor might not work for another, depending on their individual circumstances. That said, there are some universal principles that should guide any portfolio construction process.

2.1 Asset Allocation: The Foundation of Your Portfolio

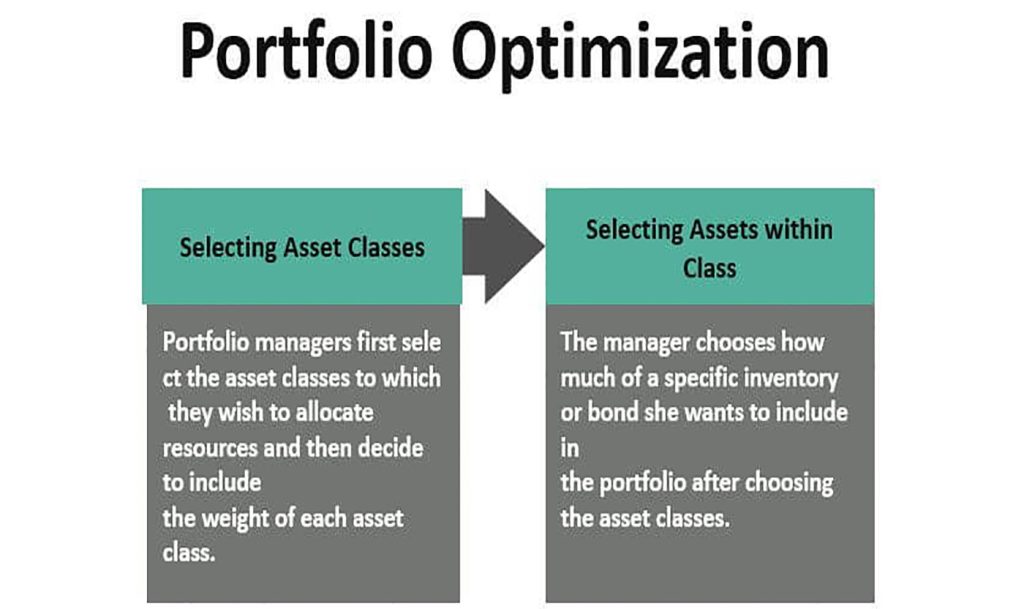

At the heart of every strong investment portfolio is asset allocation. This refers to the way you divide your investments across different asset classes—such as stocks, bonds, real estate, and cash. The main goal of asset allocation is to spread risk and maximize returns based on your goals.

In 2024, investors typically allocate their funds into the following categories:

- Stocks (Equities): These are ownership shares in companies and tend to offer higher potential returns but also come with higher volatility.

- Bonds: Fixed-income investments that pay regular interest and tend to be more stable, providing a buffer against stock market volatility.

- Real Estate: Property investments can provide both income and appreciation, though they tend to be less liquid.

- Cash or Cash Equivalents: These are low-risk assets like money market funds or short-term government bonds that provide safety and liquidity but with low returns.

- Alternative Investments: These include investments in commodities, cryptocurrencies, private equity, and ESG-focused funds, which can offer diversification and growth opportunities.

When constructing your portfolio, the key question is: how much of each asset class should you hold? This depends on several factors, including your age, risk tolerance, financial goals, and investment horizon.

2.2 Risk Tolerance: Tailoring Your Portfolio to Your Comfort Level

Risk tolerance is a critical factor in determining how your portfolio is structured. Risk tolerance refers to the amount of volatility or potential loss you are willing to endure in your investments in exchange for the possibility of higher returns.

In 2024, many investors use a risk profile questionnaire or rely on their own judgment to determine their risk tolerance. Generally, the younger you are, the more risk you can afford to take on, since you have time to recover from potential losses. Conversely, as you near retirement, you’ll likely want to reduce your exposure to riskier assets like stocks and increase your holdings in more stable investments like bonds or cash equivalents.

A common rule of thumb is the 100-minus-age rule. For example, if you’re 30 years old, you may want to invest 70% of your portfolio in stocks and 30% in bonds or cash. As you get older, you gradually shift the balance toward less risky assets.

2.3 Time Horizon: Planning for the Long-Term

Your investment horizon—or the length of time you expect to hold your investments before needing to access them—plays a significant role in how you structure your portfolio. If you have a long time horizon, you can afford to take on more risk, as you’ll have time to ride out market volatility. On the other hand, if your time horizon is shorter (e.g., you’re nearing retirement), your portfolio should be more conservative.

For example, if your goal is to retire in 30 years, you can have a more aggressive portfolio with a larger allocation to equities. However, if you plan to use the funds in five years, you’ll want a more conservative mix with a higher proportion of fixed-income investments.

2.4 Diversification: Minimizing Risk, Maximizing Growth

Diversification is one of the most important strategies for managing risk in your portfolio. By spreading your investments across different asset classes and sectors, you reduce the impact that any one investment’s poor performance will have on your overall portfolio. In 2024, diversification is more achievable than ever thanks to the variety of assets available to individual investors.

Some diversification strategies include:

- Geographical diversification: Investing in both domestic and international markets to spread risk across different economies.

- Sector diversification: Allocating your investments across various sectors (e.g., technology, healthcare, energy, consumer goods) to reduce exposure to industry-specific risks.

- Asset class diversification: Mixing different types of assets (stocks, bonds, real estate, etc.) to balance the risk-reward ratio.

Platforms like Morningstar, Yahoo Finance, and Fidelity offer tools and resources to help you track your diversification and make adjustments as needed.

3. Optimizing Your Portfolio for Maximum Returns

Once your portfolio is built, the next step is optimization. Optimizing your portfolio means fine-tuning your asset allocation to achieve the best possible returns while maintaining an acceptable level of risk.

3.1 Rebalancing Your Portfolio

Over time, the performance of different asset classes will cause your portfolio’s allocation to shift. For instance, if stocks have performed well, their value may increase, causing them to make up a larger portion of your portfolio than originally intended. This can skew your risk profile, making the portfolio more volatile than you are comfortable with.

Rebalancing involves periodically adjusting your portfolio to bring the asset allocation back to your original target. For example, if your target allocation is 70% stocks and 30% bonds, but after a period of growth, your portfolio is now 80% stocks and 20% bonds, you would sell some stocks and purchase more bonds to restore your desired balance.

Rebalancing is essential for managing risk and ensuring that your portfolio continues to align with your financial goals. Most investors rebalance their portfolios at least once a year, but it can be done more frequently if needed.

3.2 Tax Efficiency: Minimizing Your Tax Burden

In 2024, it’s more important than ever to consider tax efficiency when building and optimizing your portfolio. Taxes can significantly erode the returns on your investments, especially over the long term. That’s why it’s crucial to consider tax implications when making investment decisions.

Some strategies to enhance tax efficiency include:

- Tax-advantaged accounts: Contributing to retirement accounts like IRAs or 401(k)s can reduce your taxable income and allow your investments to grow tax-deferred.

- Capital gains management: Long-term capital gains (from assets held for over a year) are taxed at a lower rate than short-term capital gains. You can reduce your tax burden by holding assets for longer periods.

- Tax-loss harvesting: Selling investments that have lost value in order to offset gains in other parts of your portfolio.

Using tools like TaxAct, TurboTax, or consulting with a tax professional can help ensure that your portfolio remains as tax-efficient as possible.

3.3 Staying Disciplined and Avoiding Emotional Decisions

One of the biggest challenges investors face is staying disciplined in the face of market volatility. The emotional side of investing can often lead to poor decision-making, such as panic selling during market downturns or chasing hot stocks during bull runs.

In 2024, with the volatility brought about by economic uncertainty, geopolitical events, and technological disruptions, it’s easy to get swept up in market movements. However, it’s crucial to stay focused on your long-term goals and stick to your plan.

Using a systematic investment approach, such as dollar-cost averaging (DCA), can help you stay disciplined. DCA involves investing a fixed amount of money at regular intervals, regardless of market conditions, which helps mitigate the impact of short-term volatility.

4. Adapting Your Portfolio to Changing Market Conditions

The financial landscape is constantly evolving. As an investor, it’s essential to adapt your portfolio to changing conditions. This means staying informed about the global economy, interest rates, inflation, geopolitical events, and technological advancements, all of which can have an impact on your investments.

In 2024, some key trends to keep an eye on include:

- Inflation concerns: Rising inflation can erode the purchasing power of your returns. Investing in inflation-protected securities (such as TIPS) or commodities like gold can provide a hedge against inflation.

- Interest rate changes: Central banks, such as the Federal Reserve, have been adjusting interest rates to combat inflation. Changes in interest rates can affect asset prices, especially bonds and real estate.

- Sustainability and ESG investing: More investors are focusing on environmental, social, and governance (ESG) factors when making investment decisions. ESG funds have become increasingly popular, and companies with strong ESG practices may outperform those without.

Websites like Bloomberg, CNBC, and The Wall Street Journal can help you stay updated on market trends and news.

5. Resources to Help You Build and Optimize Your Portfolio

To help with building and optimizing your portfolio, there are several online tools and platforms that provide valuable resources and services:

- Morningstar: Offers research, ratings, and investment tools to help you build a diversified portfolio.

- Fidelity and Vanguard: Both offer comprehensive portfolio-building tools, robo-advisory services, and low-cost investment options.

- Wealthfront and Betterment: Provide automated investment management, or robo-advisory, to help optimize your portfolio based on your goals and risk tolerance.

- Seeking Alpha and Yahoo Finance: Great resources for market analysis, news, and stock research to make informed decisions.

Building and optimizing an investment portfolio is a dynamic and ongoing process that requires careful planning, attention to detail, and the ability to adapt to changing circumstances. As we move through 2024, the financial landscape continues to evolve, presenting new opportunities and risks for investors. By following the principles of asset allocation, diversification, and risk management, and by using the right tools and resources, you can create a portfolio that not only meets your financial goals but also puts you on the path to financial freedom.

While the road to financial freedom can be long, the right investment strategy will help you make steady progress toward your ultimate goal. Stay disciplined, stay informed, and remember that the journey is just as important as the destination.