In the world of investing, there are a few names that stand out not just because of the wealth they’ve accumulated, but because of the strategies they’ve consistently used to build and sustain their fortunes. People like Warren Buffett, Charlie Munger, Ray Dalio, Carl Icahn, and Peter Lynch are revered for their ability to navigate market complexities and achieve outstanding returns year after year. These individuals aren’t just successful by chance; their investment philosophies are based on well-thought-out strategies, deep understanding of markets, and disciplined approaches.

Whether you’re just starting out or looking to refine your approach, understanding and adopting elements of these titans’ investment strategies can significantly improve your decision-making process. While each of these legendary investors has their unique approach, there are common principles that they all share. In this article, I’ll break down the key strategies employed by the most successful investors and offer practical advice on how you can incorporate these lessons into your own investment journey.

1. The Power of Long-Term Thinking: Warren Buffett and the Virtue of Patience

Warren Buffett, perhaps the most famous investor of all time, has repeatedly demonstrated that patience is a core element of success in investing. His philosophy is built around the idea that buying and holding quality stocks over the long term is the most reliable way to generate substantial wealth.

Buffett’s Strategy:

Buffett’s approach to investing centers around value investing—finding high-quality companies that are undervalued by the market. He believes in investing in businesses, not stocks, which means he looks for companies with strong fundamentals, competent management, and a competitive edge in their industry. Buffett’s famous rule is simple: “Buy and hold forever”. However, this doesn’t mean buying just any company; it’s about identifying companies that have a consistent track record of performance, a clear competitive advantage, and a capable management team.

- What I Learned: The key takeaway from Buffett is to focus on long-term growth rather than short-term gains. Patience pays off—holding onto quality investments allows the power of compound interest to work in your favor.

- What You Can Do: Focus on buying companies that you believe will thrive over the long haul. Evaluate the company’s fundamentals—such as its earnings growth, competitive positioning, and future prospects. Once you identify such companies, hold them through market fluctuations, trusting that, over time, they will appreciate in value.

Resources:

- Berkshire Hathaway Annual Letters: These provide deep insights into Buffett’s thought process and strategy. They are an invaluable resource for anyone looking to learn more about his investment philosophy.

- Yahoo Finance: For research on stocks and their performance, this platform is excellent for evaluating potential long-term investments.

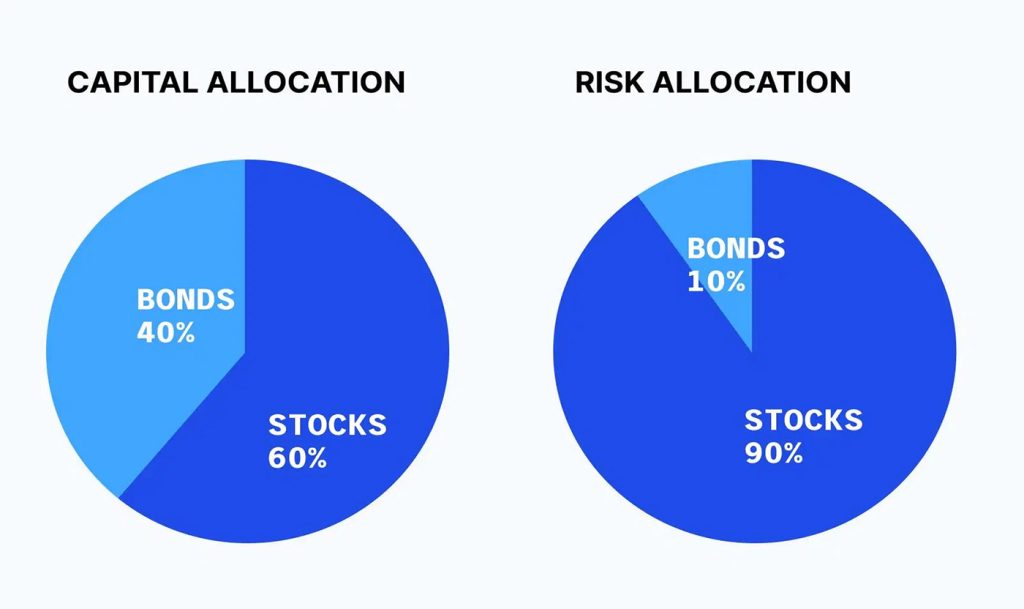

2. Diversification: Ray Dalio’s Principles of Risk Parity

Ray Dalio, the founder of Bridgewater Associates and one of the wealthiest hedge fund managers in the world, believes that diversification is one of the most important aspects of successful investing. His “Pure Alpha” strategy focuses on managing risk and seeking steady returns by diversifying investments across different asset classes, industries, and geographies.

Dalio’s Strategy:

Dalio’s approach revolves around what he calls the “Principles of Risk Parity”—the idea that balancing risk across a range of assets is crucial to reducing overall portfolio volatility and ensuring consistent returns. His strategy involves dividing investments into multiple asset classes such as stocks, bonds, commodities, and even currencies, so that the portfolio is not overly dependent on one type of investment.

Dalio’s famous strategy involves diversifying not just across stocks and bonds, but also into assets that behave differently under various market conditions. For instance, if stocks are going through a downturn, commodities like gold might perform better, helping to offset losses.

- What I Learned: Dalio’s strategy is about minimizing risk while maximizing long-term returns. It’s not just about picking good assets, but about balancing them in a way that each one plays a role in offsetting potential losses during market fluctuations.

- What You Can Do: Diversify your portfolio. Invest not only in stocks but in bonds, commodities, real estate, and even foreign markets. By spreading out your investments, you can reduce the impact of any one market downturn on your overall portfolio.

Resources:

- Bridgewater’s “Principles”: Dalio’s book, Principles, outlines his investment philosophy and provides insight into his approach to risk management.

- Morningstar: This platform can help you analyze various asset classes and build a diversified portfolio.

3. The Growth Mindset: Peter Lynch’s Stock Picking Formula

Peter Lynch, the former manager of the Fidelity Magellan Fund, turned a $18 million investment fund into $14 billion during his tenure. His approach, which emphasizes finding growth stocks in companies with strong potential for future earnings, has made him a legend in the investment world.

Lynch’s Strategy:

Lynch famously said, “Invest in what you know.” This simple phrase captures the essence of his strategy. Lynch believed that individual investors have a unique advantage because they can discover great investment opportunities in their everyday lives—whether that’s noticing a popular restaurant chain or a product that’s gaining traction among consumers. He advocated for looking for growth stocks in industries you understand, researching them, and holding them as long as their fundamentals remain strong.

Lynch’s “ten-bagger” strategy revolves around finding stocks that have the potential to grow ten times in value. To identify these stocks, he focused on companies with strong earnings growth, low debt, and solid management teams.

- What I Learned: One of the best ways to find winning investments is to look for companies that are growing in a sector you understand. If you use a product or service regularly and see others doing the same, it’s worth investigating the company behind it.

- What You Can Do: Pay attention to the industries and products you are passionate about. Keep an eye on small companies with the potential to grow significantly. Look for strong earnings growth, low debt, and competent leadership as key factors in your stock selection process.

Resources:

- Fidelity: Fidelity offers research tools that can help you track stocks with strong growth potential, including their earnings reports and valuation metrics.

- Investopedia: Investopedia is great for learning about stock metrics, including how to evaluate growth stocks and spot potential winners.

4. The Activist Investor’s Approach: Carl Icahn and Strategic Influence

Carl Icahn, a prominent activist investor, is known for taking substantial stakes in companies and pushing for change to unlock value. Unlike many traditional investors who prefer to remain hands-off, Icahn actively influences the companies he invests in, often pushing for changes in management, cost-cutting, or business strategy to improve profitability.

Icahn’s Strategy:

Icahn’s approach is based on identifying undervalued companies with poor management or ineffective strategies. He then buys a large stake in the company, makes his influence known, and pushes for changes that he believes will unlock value. Icahn isn’t just a passive investor—he’s an active participant in improving the companies he invests in.

- What I Learned: Sometimes, investing isn’t just about buying and holding stocks; it can also involve taking an active role in improving a company’s prospects. While this approach may be more complex and risky, it can lead to outsized returns if done correctly.

- What You Can Do: If you have the patience and ability to engage with management, consider looking for undervalued companies with weak leadership. By becoming an active shareholder, you can help drive the changes necessary to boost the company’s stock price.

Resources:

- Icahn Enterprises: Icahn’s investment firm often provides insights into the types of companies he’s targeting and the strategies he uses.

- Seeking Alpha: Seeking Alpha is a great platform for finding news on activist investing and following the moves of major investors like Icahn.

5. The Importance of Emotional Control: Charlie Munger’s Focus on Psychology

Charlie Munger, Buffett’s right-hand man at Berkshire Hathaway, is known for his emphasis on psychology in investing. Munger believes that one of the key factors that differentiate successful investors from unsuccessful ones is emotional control. He often speaks about how investors are their own worst enemies, making decisions based on fear, greed, or impatience.

Munger’s Strategy:

Munger’s philosophy is about applying rational thinking and psychological principles to investing. He stresses the importance of understanding cognitive biases—the mental shortcuts that lead people to make irrational decisions. Munger suggests that successful investing requires a calm, disciplined mindset, as well as the ability to ignore market noise and focus on the long-term potential of your investments.

- What I Learned: Emotional control is often more important than the investment strategy itself. Being able to withstand market fluctuations without making rash decisions is key to long-term success.

- What You Can Do: Work on managing your emotions while investing. Focus on sticking to your strategy, and avoid making decisions based on short-term market movements or news headlines.

Resources:

- The Munger Collection: This collection of speeches and writings by Charlie Munger provides a deeper understanding of his investment philosophy and his insights into psychological biases.

- The Motley Fool: The Motley Fool is a great resource for staying grounded in long-term investing strategies and avoiding emotional pitfalls.

The world’s most successful investors—whether they’re value investors like Warren Buffett, growth investors like Peter Lynch, or activist investors like Carl Icahn—have proven that consistent success in the market comes from a blend of patience, discipline, risk management, and psychological fortitude. While each investor’s strategy is unique, the principles that guide them are universal.

For anyone looking to invest successfully in 2024, learning from the strategies of these titans is a step in the right direction. By focusing on long-term thinking, diversification, growth potential, and emotional control, you can build a strong foundation for achieving your financial goals.