The world of investing can feel like a complex maze, full of opportunities, risks, and, unfortunately, traps that many new investors unknowingly fall into. In 2024, more and more people are diving into the world of stocks, ETFs, cryptocurrencies, and other assets, spurred on by the democratization of financial tools and information. While this has empowered a new generation of investors, it has also led to a spike in mistakes, especially among beginners. I’ve been there too — early in my investing journey, I made countless errors that cost me both time and money.

In this article, I’ll dive deep into the common pitfalls that new investors make and share the lessons I’ve learned along the way. I’ll also provide actionable advice to help you avoid these mistakes, build a stronger investment strategy, and improve your financial literacy.

1. Overlooking the Importance of Financial Education

One of the biggest mistakes I see among new investors is the failure to educate themselves properly before diving into the market. When I first started, I relied on superficial knowledge — a quick article here, a YouTube video there, and a recommendation from a friend. It’s easy to get caught up in the excitement, but investing requires a deep understanding of the fundamentals.

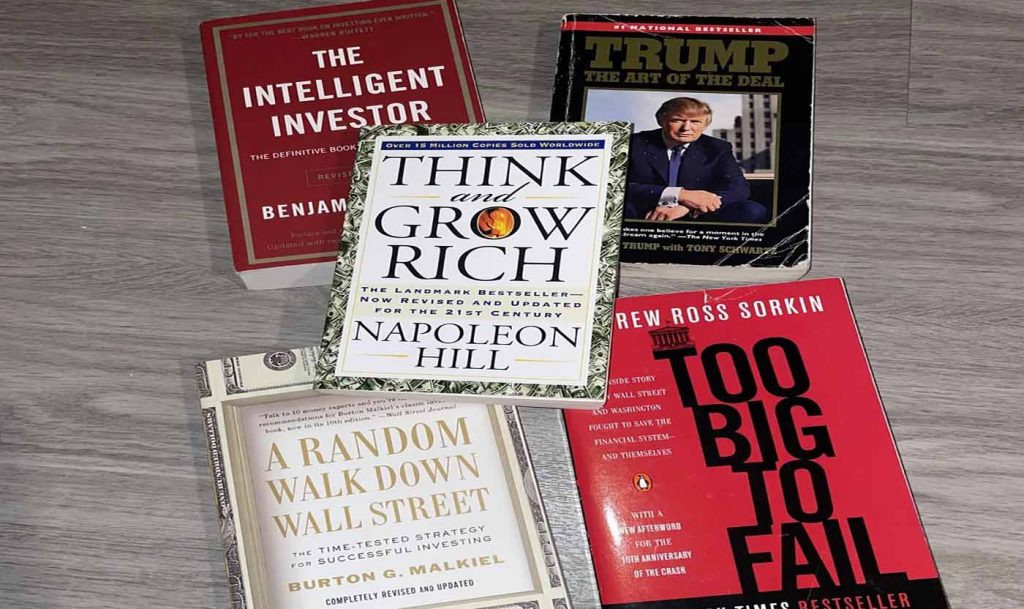

Tip: Start by reading books and articles from reputable sources like The Intelligent Investor by Benjamin Graham and A Random Walk Down Wall Street by Burton Malkiel. Make sure you understand concepts like risk, diversification, compound interest, and asset allocation before you start buying stocks. Websites like Investopedia and Morningstar are great places to find in-depth articles and tutorials.

2. Chasing Quick Gains

Another mistake I made early on was chasing quick profits. There’s a temptation to jump into hot stocks or cryptocurrencies that promise rapid returns. However, as I learned the hard way, investing is a long-term game. Quick gains often come with high risks, and they’re usually unsustainable. The stories of people making fortunes in a matter of weeks often overshadow the many who lose everything.

Tip: Focus on long-term growth rather than short-term gains. Build a diversified portfolio that reflects your financial goals and risk tolerance. Instead of looking for the next “big thing,” consider investing in companies or funds with strong fundamentals and a track record of performance. Websites like Yahoo Finance and Seeking Alpha can provide research on the performance of various companies and sectors.

3. Failing to Diversify Your Portfolio

When I first began investing, I put too much of my money into a handful of stocks that I believed would perform well. In hindsight, this was one of the most significant mistakes I made. It’s easy to get attached to a particular stock or sector, but concentrating your investments on one asset class or company increases risk.

Tip: Diversification is one of the simplest and most effective strategies to reduce risk. Spread your investments across different sectors, asset classes (stocks, bonds, real estate, etc.), and geographies. Exchange-traded funds (ETFs) and mutual funds are excellent tools for building a diversified portfolio. For further reading, check out Vanguard for their educational resources on portfolio diversification.

4. Letting Emotions Drive Investment Decisions

One of the most challenging lessons I had to learn was controlling my emotions during market volatility. I’ve been in situations where the market was plummeting, and I panicked — selling stocks in a rush to avoid further losses. Likewise, when the market was soaring, I got greedy and overextended myself, chasing hot stocks with no real strategy. Both reactions proved to be costly.

Tip: Develop a disciplined investment strategy that doesn’t rely on emotional reactions. Set clear goals and a plan, then stick to it regardless of short-term market fluctuations. Keep in mind that investing is a marathon, not a sprint. When markets dip, consider it an opportunity to buy at lower prices. Tools like Personal Capital can help you keep track of your investments and stay aligned with your long-term strategy.

5. Ignoring Fees and Expenses

Fees can significantly erode your returns over time, yet many new investors overlook them. When I started, I didn’t fully grasp how trading commissions, fund management fees, and other expenses could eat into my profits. I’d focus solely on the performance of my investments without considering the cost of getting in and out of them.

Tip: Always pay attention to the fees associated with the investments you’re considering. Look at both the expense ratio of mutual funds or ETFs and any transaction fees from brokers. Low-cost index funds and ETFs, like those offered by Fidelity and Charles Schwab, are great options to minimize fees while gaining exposure to a broad market.

6. Focusing Too Much on Timing the Market

Trying to time the market is a risky and often fruitless endeavor. I spent a lot of time and energy trying to figure out the “perfect” time to buy and sell, only to realize that timing the market consistently is nearly impossible. Market conditions can change in an instant, and even the most experienced investors can’t predict short-term fluctuations with certainty.

Tip: Instead of trying to time the market, focus on time in the market. Regularly investing, regardless of market conditions, through strategies like dollar-cost averaging (DCA), can reduce the risk of making poor decisions based on short-term volatility. Dollar-cost averaging can help you manage risks by spreading out your investments over time.

7. Overtrading

In the early days, I was an active trader, constantly buying and selling stocks based on short-term market movements. The more I traded, the more I realized how detrimental this behavior was to my overall portfolio performance. Overtrading often leads to higher transaction costs and taxes, which can diminish long-term returns.

Tip: Stick to a long-term investment strategy and avoid overtrading. Buy quality investments that you believe in for the long haul and let them grow over time. Use tools like TD Ameritrade or Robinhood to manage trades effectively, but focus on the long-term performance of your portfolio.

8. Falling for “Get-Rich-Quick” Schemes

It’s easy to get drawn into the hype of “get-rich-quick” schemes, especially with the rise of cryptocurrency and high-risk speculative investments. I’ve fallen into this trap, chasing after high-return, high-risk opportunities without fully understanding the risks involved. These types of investments can promise massive returns, but they often come with equally massive losses.

Tip: Stick to tried-and-true investing principles: invest in companies with strong fundamentals and track records, and avoid speculative investments that you don’t fully understand. Focus on building wealth steadily over time rather than trying to get rich overnight. Websites like CoinDesk provide reliable information on cryptocurrencies, while Investopedia offers general investing tips.

9. Neglecting Risk Management

Risk management is a crucial aspect of investing that many new investors overlook. Early on, I didn’t understand how to assess the risks of my investments properly. Instead, I focused only on potential returns, ignoring how much I stood to lose in a downturn.

Tip: Always assess the risk associated with each investment you make. Use risk management strategies like stop-loss orders, portfolio diversification, and regular rebalancing to ensure that your risk level aligns with your financial goals. Wealthfront and Betterment are robo-advisors that offer automated risk management tools to help keep your investments balanced.

10. Ignoring Taxes

Taxes can take a significant chunk out of your investment returns, but many new investors don’t consider the tax implications of their decisions. I’ve made this mistake too, failing to account for capital gains taxes or overlooking tax-advantaged accounts like IRAs and 401(k)s.

Tip: Be mindful of the tax consequences of your investments. Consider holding investments in tax-advantaged accounts, such as IRAs, to defer taxes and increase your returns over time. Tax-efficient investing strategies, like holding stocks for more than a year to benefit from long-term capital gains rates, can also help you minimize taxes. Websites like Tax Foundation can help you stay updated on tax laws related to investments.

Avoiding the Pitfalls and Becoming a Smarter Investor

Investing is a journey, and mistakes are part of the learning process. However, by recognizing these common pitfalls and learning from them, you can avoid costly mistakes and build a solid foundation for your financial future. Start by educating yourself, building a diversified portfolio, and focusing on long-term strategies. Be patient, disciplined, and always mindful of the risks involved.

The key to successful investing is continuous learning. Keep reading, stay informed, and don’t be afraid to make mistakes. The best investors are the ones who learn from their errors, adapt, and keep pushing forward. With time, you’ll become more confident in your decisions and find yourself on a path toward financial success.