As we approach the end of 2024, the global economy stands at a significant crossroads. The aftermath of the COVID-19 pandemic continues to shape markets, inflation remains a key concern for many countries, and geopolitical tensions—particularly the ongoing conflict in Eastern Europe—have led to increased uncertainty. At the same time, technological advancements, particularly in artificial intelligence and green energy, are creating new opportunities in various sectors.

As an investor, this presents a unique challenge: how to navigate a market filled with volatility while making informed decisions that can lead to long-term success. Understanding the macroeconomic trends that will shape 2024 is crucial for making the right moves, and in this article, I will explore the major factors influencing global markets this year and share practical strategies to help you respond effectively to market fluctuations.

1. Understanding the Key Economic Trends in 2024

Before we delve into how to deal with market volatility, it’s important to take a step back and understand the broader economic landscape. 2024’s global economic outlook is influenced by several factors:

Inflation and Interest Rates

One of the most significant ongoing issues is inflation. Although inflation rates in many developed countries have slightly decreased from the peaks experienced in 2021 and 2022, they remain above historical norms in most economies. Central banks, particularly the U.S. Federal Reserve and the European Central Bank (ECB), have implemented aggressive interest rate hikes in an attempt to tame inflation.

However, the question in 2024 is whether these rate hikes will have the desired effect on inflation without causing a significant slowdown in economic growth. Central banks are walking a tightrope—tightening monetary policy to combat inflation, but not too much to trigger a recession. This delicate balance will affect the investment climate throughout the year.

Geopolitical Risks and Global Tensions

The geopolitical landscape remains unstable, particularly in Europe and Asia. The conflict in Ukraine has created energy supply disruptions and strained relations between the West and Russia. At the same time, tensions between China and Taiwan, and the ongoing trade and diplomatic challenges between the U.S. and China, continue to create uncertainty.

These geopolitical risks could cause sudden market fluctuations. For example, any escalation in the war in Ukraine could drive up energy prices or cause further supply chain disruptions, which would negatively impact global markets. On the flip side, a de-escalation of tensions, especially between the U.S. and China, could create new opportunities for growth.

Technological Advancements and Green Energy

On a more positive note, technological advancements, particularly in the fields of artificial intelligence, automation, and green energy, are creating new sectors of growth. AI continues to revolutionize industries, from healthcare to finance to manufacturing. At the same time, the global shift toward renewable energy sources and electric vehicles presents long-term investment opportunities.

However, these growth areas come with their own risks. Regulatory challenges, technological setbacks, or even competition from other innovations could prevent these sectors from meeting their lofty expectations. Investors should monitor these industries closely and be prepared for volatility in the short term.

2. The Impact of Market Volatility on Your Investment Portfolio

Market volatility is a given in the world of investing, and 2024 is shaping up to be no exception. There will be moments of sharp market declines, followed by periods of recovery, and everything in between. Understanding how these fluctuations affect your portfolio—and how you can respond—will be critical to your investment success.

Stock Market Volatility

Stock markets are particularly susceptible to volatility during uncertain economic times. In 2024, with inflation concerns, interest rate hikes, and geopolitical tensions, we are likely to see periods of market instability. For example, sectors that are more sensitive to interest rates—such as technology and real estate—could face more significant declines if central banks continue to raise rates.

While this volatility can be nerve-wracking for investors, it’s important to remember that market downturns often create buying opportunities. History has shown that the stock market tends to recover over time, and long-term investors who remain patient through short-term volatility are often rewarded.

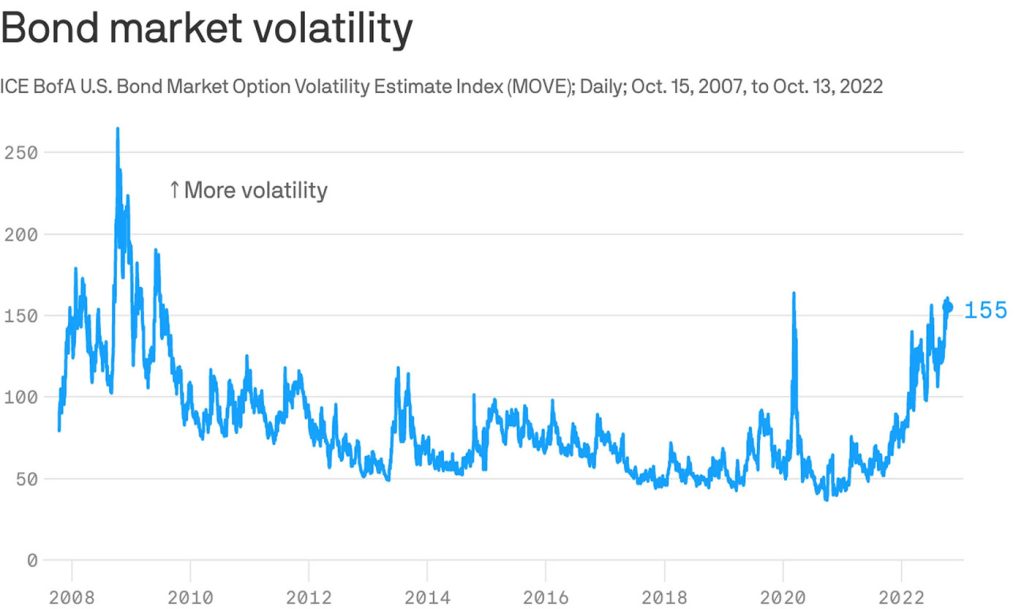

Bond Market Volatility

The bond market also faces volatility in 2024. Rising interest rates have made bonds less attractive because they offer lower yields compared to stocks and other riskier assets. As interest rates continue to rise, bond prices are expected to decline, making it more difficult for bond investors to achieve the same returns they’ve enjoyed in previous years.

However, certain types of bonds, such as inflation-protected securities (like TIPS in the U.S.), could offer protection in an inflationary environment. It’s important to reassess your bond holdings regularly to ensure they align with your investment goals.

Commodity Market Volatility

Commodities, especially oil and precious metals, are another asset class that can experience high volatility during times of geopolitical and economic uncertainty. Oil prices, for instance, have been heavily influenced by the conflict in Ukraine and global energy demand. Geopolitical events in key oil-producing countries can lead to sharp price swings.

While commodity investments can offer diversification, they can also be highly speculative. For long-term investors, commodities should be considered more of a hedge against inflation and market turbulence rather than a core component of the portfolio.

3. Strategies for Navigating Volatility in 2024

The key to thriving in volatile markets is adopting a mindset that is both flexible and long-term focused. Here are some practical strategies that will help you navigate market volatility in 2024:

Maintain a Diversified Portfolio

One of the most effective ways to protect your portfolio from market swings is through diversification. By investing in a variety of asset classes—such as stocks, bonds, commodities, and real estate—you can reduce the impact of a downturn in any one particular area.

In 2024, consider diversifying both geographically and sectorally. For example, if you primarily invest in U.S. stocks, you might want to add exposure to emerging markets or European equities. Similarly, you can balance your portfolio with defensive sectors like healthcare and consumer staples, which tend to perform better during market downturns.

Focus on Long-Term Goals

While short-term volatility can be unnerving, it’s important to keep your long-term investment goals in focus. Whether you’re saving for retirement, a large purchase, or financial independence, it’s crucial to stay the course during periods of market turbulence.

Long-term investors should resist the temptation to react impulsively to short-term market fluctuations. Historically, the stock market has delivered strong returns over long periods, even after major economic disruptions. By staying invested through volatility, you give your investments the best chance to grow.

Rebalance Your Portfolio Regularly

Regularly rebalancing your portfolio is essential to maintaining your desired risk level. As the value of different assets fluctuates during periods of volatility, some parts of your portfolio may become overweighted, exposing you to more risk than you originally intended.

For instance, if a large stock rally causes your equity holdings to rise significantly in value, you might want to sell some of those stocks and reallocate the proceeds into bonds or cash. Similarly, if bonds have underperformed due to rising interest rates, you may need to adjust your holdings to reduce exposure to this sector.

Consider Dollar-Cost Averaging

If you’re nervous about market timing and unsure when to enter or exit the market, consider using dollar-cost averaging (DCA). With DCA, you invest a fixed amount of money at regular intervals, regardless of market conditions. Over time, this strategy can help you avoid buying all at once at a market peak and take advantage of market dips.

DCA works especially well for long-term investors who don’t need immediate access to their funds and are looking to build wealth over many years.

Stay Informed, but Avoid Overreacting

In today’s information age, it’s easy to become overwhelmed by the constant news cycle and market commentary. While it’s important to stay informed about global events and market trends, it’s also essential to avoid emotional decision-making based on short-term news. Fear and greed are often the worst advisors for investors, leading to panic selling during downturns or excessive buying during euphoric periods.

Instead of reacting impulsively, take the time to process information, reassess your goals, and make decisions based on logic and strategy, not emotion.

4. Recommended Resources for Investors

As we move through 2024, there are several online resources that can help investors stay informed and make sound decisions in a volatile market:

- Investopedia (www.investopedia.com): A comprehensive resource for learning about investment terms, strategies, and trends. The site also offers market analysis and news updates.

- Yahoo Finance (finance.yahoo.com): A great platform for checking stock prices, company performance, and news about global events that might impact your investments.

- The Motley Fool (www.fool.com): Provides expert insights and advice for investors at all levels, particularly in stock market investing.

- Bloomberg (www.bloomberg.com): Known for its real-time market analysis and financial news, Bloomberg is an essential resource for tracking the latest trends in the economy and financial markets.

- Morningstar (www.morningstar.com): Offers in-depth analysis of mutual funds, ETFs, and stocks. They also provide tools for portfolio management and performance tracking.

The global economy in 2024 is expected to be marked by both challenges and opportunities. Navigating market volatility requires a blend of knowledge, patience, and strategic thinking. By staying informed about the broader economic trends, diversifying your portfolio, focusing on your long-term goals, and maintaining flexibility in your approach, you can weather the inevitable ups and downs of the market.

While we can’t predict the future with certainty, the steps outlined in this article will help you make more informed decisions, reduce risk, and position yourself to take advantage of opportunities as they arise.

Good luck, and may your investment journey in 2024 be filled with thoughtful decisions and successful outcomes.