As we approach 2024, it’s evident that the financial world is undergoing a transformation. Technology has always been a driving force in investing, but there’s a new player in town that’s changing the game: artificial intelligence (AI). AI is no longer just a buzzword; it’s revolutionizing how we analyze the stock market, make investment decisions, and even manage our portfolios. In this article, we’ll explore how AI is altering the landscape of investing, the potential trends we’re likely to see in the future, and how investors can leverage these advancements to gain an edge in the market.

1. Understanding Artificial Intelligence in the Context of the Stock Market

Before we dive into the specifics, let’s take a step back and understand what artificial intelligence actually means in the context of stock market investing. AI encompasses a broad range of technologies, including machine learning, natural language processing (NLP), and predictive analytics. When applied to the stock market, these technologies allow for more efficient and data-driven decision-making.

AI systems can analyze vast amounts of financial data in a fraction of the time it would take a human. This includes historical stock prices, company earnings reports, news headlines, social media sentiment, and much more. These insights are then used to make predictions, identify trends, and even automate trading decisions.

In essence, AI is enhancing the speed, accuracy, and efficiency of stock market analysis, while also opening up new avenues for investors to explore.

2. AI’s Role in Data Analysis and Predictive Analytics

One of the primary ways AI is changing the stock market is through predictive analytics. Traditional stock research relies on human analysis of financial statements, trends, and market movements. While experienced investors can make educated predictions based on these factors, they are still limited by time and cognitive bias.

AI, however, is capable of analyzing massive datasets, spotting patterns, and making predictions with a level of precision that humans cannot achieve. Machine learning algorithms can sift through years of historical stock data to identify correlations that might be invisible to the human eye. AI can also consider alternative data sources—such as satellite imagery, social media sentiment, and even web traffic data—to inform its predictions.

For instance, AI tools can track a company’s social media presence to gauge public sentiment about its products, leadership, or future prospects. Positive sentiment can indicate potential growth, while negative sentiment may signal future challenges. Additionally, AI can analyze global news in real time, quickly processing events that could affect stock prices, from political upheavals to natural disasters.

A great tool for leveraging AI-driven data analysis is TradingView, a platform that integrates advanced charting tools with AI-powered insights to help traders make data-backed decisions.

Explore TradingView here: www.tradingview.com

3. AI and Algorithmic Trading: The Rise of Machines in the Market

Another game-changing application of AI in the stock market is algorithmic trading. Algorithmic trading, often referred to as “algo trading,” involves using AI-powered algorithms to execute buy and sell orders based on pre-set criteria, such as price targets, volume, and market conditions.

These AI-driven algorithms can operate at lightning speed, executing trades in milliseconds. This is a significant advantage in a market where every second counts, and even small price fluctuations can create substantial opportunities for profit. Unlike human traders, AI systems don’t experience emotions like fear or greed, which can often cloud judgment during volatile market conditions. As a result, AI systems can make rational, objective decisions based solely on the data available.

For example, Robo-advisors like Betterment and Wealthfront use AI to automatically manage portfolios for investors based on their risk tolerance, investment goals, and time horizon. These platforms utilize machine learning algorithms to optimize asset allocations and ensure your portfolio is well-diversified without the need for manual intervention.

Check out Betterment here: www.betterment.com

Explore Wealthfront here: www.wealthfront.com

Additionally, AI is helping institutional traders by enabling high-frequency trading (HFT) strategies, where computers analyze market data and execute trades in fractions of a second, making it virtually impossible for human traders to compete.

While this may sound intimidating to retail investors, it’s important to remember that AI-driven tools are now available for individuals too. Retail investors can now access robo-advisors, algorithmic trading platforms, and AI-powered research tools that were once exclusive to large institutional investors.

4. AI-Powered Sentiment Analysis: What Are Investors Thinking?

The power of AI extends beyond hard data into the realm of sentiment analysis, which focuses on understanding market psychology. Sentiment analysis uses natural language processing (NLP) to analyze textual data—such as news articles, social media posts, earnings calls, and analyst reports—to gauge the collective mood of investors toward a particular stock or sector.

By scanning social media platforms like Twitter and Reddit, AI can determine whether investors are feeling bullish or bearish about a company. It can also analyze the tone of articles published by financial media outlets to identify potential market-moving events. For example, if a major tech company releases a new product, AI could track news articles and social media posts to see how investors are reacting to the announcement and whether it’s likely to drive the stock price up or down.

StockTwits is a popular platform where investors share real-time thoughts on stocks. AI tools can mine this data to provide insights into market sentiment. Platforms like Sentiment Investor and Stocktwits are integrating AI to track these sentiments and help investors understand how news and social chatter are impacting stock movements.

Check out StockTwits here: www.stocktwits.com

5. AI and ESG Investing: A New Era of Sustainable Investing

In recent years, there has been a growing trend toward Environmental, Social, and Governance (ESG) investing. Investors are increasingly interested in not just financial returns, but also in the ethical impact of their investments. AI plays a key role in ESG investing by helping investors track and evaluate companies based on their sustainability practices and governance structures.

AI can process vast amounts of unstructured data—such as sustainability reports, news articles, and environmental impact statements—to assess a company’s ESG performance. AI systems can also analyze whether a company’s practices align with investors’ values. For example, AI could assess a company’s carbon footprint, supply chain practices, or diversity and inclusion efforts to determine if it meets ESG criteria.

Several platforms, like Sustainalytics and Morningstar, are now integrating AI tools to help investors make better ESG decisions. Morningstar’s AI-powered tools can screen for companies with strong ESG practices, enabling investors to create portfolios that align with their values.

Explore Morningstar’s ESG tools here: www.morningstar.com

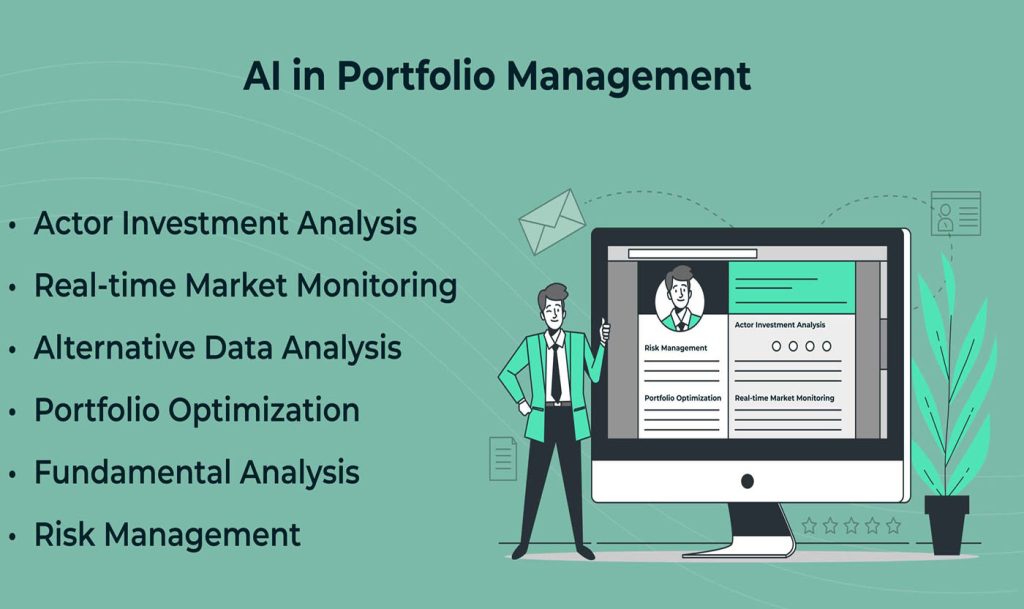

6. AI and Portfolio Management: Personalized, Data-Driven Investment Strategies

In addition to algorithmic trading, AI is transforming portfolio management by offering more personalized investment strategies. AI can evaluate an investor’s financial situation, risk tolerance, investment goals, and time horizon to create a customized portfolio. Over time, the AI system can adjust the portfolio as market conditions change or as the investor’s goals evolve.

For example, Charles Schwab Intelligent Portfolios uses AI to offer automated investment management, balancing the investor’s risk and return preferences. Similarly, Acorns, a micro-investing platform, uses AI to round up users’ spare change and invest it automatically into a diversified portfolio. These platforms make it easier for everyday investors to access sophisticated, data-driven portfolio management without the need for a financial advisor.

Check out Schwab Intelligent Portfolios here: www.schwab.com

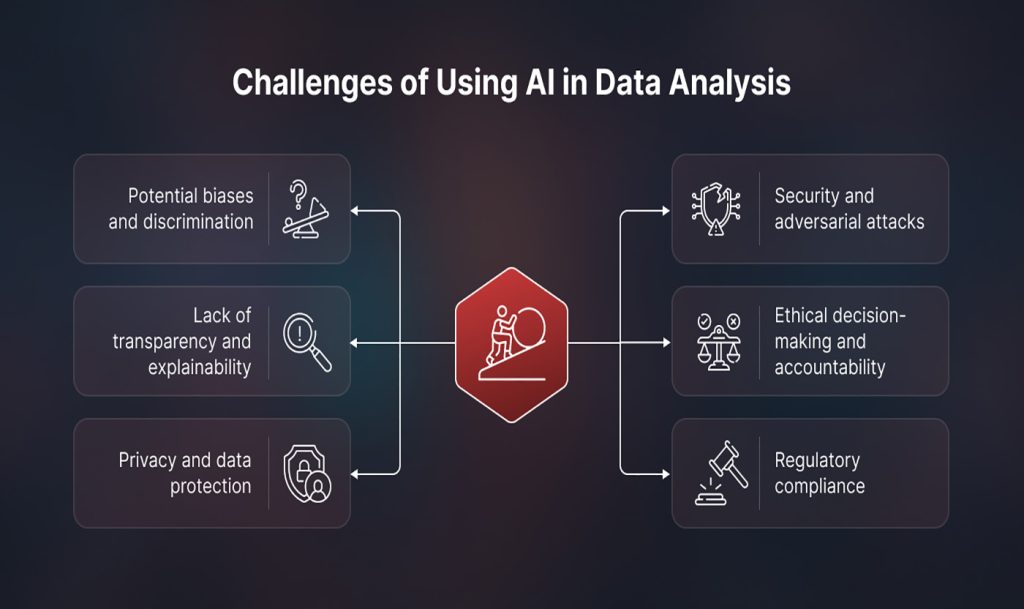

7. The Risks and Challenges of AI in Investing

While AI offers numerous advantages in the world of investing, it’s important to recognize that it’s not without its risks and challenges. One of the primary concerns is the lack of transparency in AI models. Machine learning algorithms are often referred to as “black boxes” because it can be difficult to understand how they make decisions. This could lead to situations where AI makes investment decisions that are difficult to explain or justify.

Another challenge is the over-reliance on data. AI’s effectiveness depends heavily on the quality of the data it receives. If the data is flawed or biased, the AI’s predictions and decisions could be skewed. Investors must be cautious of blindly trusting AI without a critical evaluation of the underlying data.

Finally, regulation is still catching up with the rise of AI in finance. Governments and financial institutions are working to establish guidelines and frameworks to ensure that AI tools are used ethically and transparently.

8. How Investors Can Prepare for the AI Revolution

As AI continues to reshape the stock market, it’s crucial for investors to stay informed and adapt to these changes. Here are some steps you can take to ensure you’re making the most of AI’s potential:

- Educate Yourself on AI: Understanding the basics of AI and how it works in the financial world will help you better evaluate AI-powered tools and platforms. Stay up to date with industry developments by reading articles, blogs, and reports on AI and finance.

- Use AI Tools: Take advantage of AI-powered platforms that offer stock analysis, sentiment tracking, and portfolio management. Tools like TradingView, Morningstar, and Acorns can help you incorporate AI into your investment strategy.

- Diversify Your Investments: While AI can be a powerful tool, it’s still important to diversify your investments to manage risk. Combine AI-driven insights with traditional investment strategies to create a balanced portfolio.

- Stay Critical: AI is a tool, not a magic solution. Always critically assess the recommendations and predictions made by AI systems before making investment decisions.

Embracing the Future of Investing

The future of investing is undeniably intertwined with artificial intelligence. From data analysis and predictive analytics to portfolio management and sentiment analysis, AI is transforming how we approach the stock market. By staying informed, leveraging AI tools, and using a balanced approach, investors can harness the power of AI to enhance their decision-making and build more successful investment strategies.

As we move further into 2024, it’s clear that AI will play an increasingly central role in shaping the future of finance. Embrace these advancements, and you’ll find yourself better equipped to navigate the complexities of the stock market and achieve your financial goals.