In the fast-paced world of investing, information is both an asset and a challenge. With an overwhelming number of news articles, reports, and datasets flooding the internet every day, the ability to filter out noise and extract valuable insights has become a crucial skill for investors. Whether you’re an experienced trader or a novice investor, knowing how to sift through vast amounts of financial news and data can make the difference between successful investments and costly mistakes.

In this article, I will share strategies that can help you efficiently navigate the deluge of financial information available today. I’ll discuss how to identify reliable sources, utilize analytical tools, and interpret key data points that can drive smarter investment decisions. We’ll also explore how to build a systematic approach to news consumption and data analysis that aligns with your investment goals.

1. The Information Overload: A Growing Problem

In the age of digital connectivity, investors have access to more information than ever before. News outlets, social media platforms, and financial blogs are constantly publishing updates, market predictions, and analyses. While this can be valuable, it also leads to information overload, making it difficult to separate valuable insights from the noise.

The challenge lies in distinguishing between actionable information and irrelevant or misleading noise. A large portion of financial news is designed to capture attention, often focusing on sensationalism or short-term market movements that are not necessarily indicative of long-term trends. Thus, learning how to filter and focus on what’s truly important is essential.

2. Building a Framework for Filtering Information

A good place to start is by developing a framework for filtering financial news. This framework should be grounded in your investment philosophy, risk tolerance, and specific goals. If you’re focused on long-term growth, for example, you might place less importance on daily market fluctuations and more importance on macroeconomic trends, corporate earnings reports, and geopolitical events.

Here are some steps you can take to build an effective framework:

2.1 Define Your Investment Strategy

Before diving into the sea of financial information, it’s important to clearly define your investment strategy. Are you a value investor focused on long-term stock appreciation? A growth investor looking for high-potential emerging sectors? A trader seeking short-term opportunities?

Understanding your investment style helps you prioritize the types of information you need to focus on. For example:

- Value investors may prioritize news regarding company fundamentals, such as earnings reports, management changes, and balance sheet strength.

- Growth investors may be more interested in innovation trends, technological advancements, and market disruptions.

- Traders may focus on technical indicators, market sentiment, and daily news that could move stock prices in the short term.

2.2 Identify Reliable Sources

In the world of financial media, not all sources are created equal. While mainstream media outlets can provide a broad view of the market, they may not always offer the depth of analysis you need to make informed investment decisions. That’s why identifying reliable sources of financial news and analysis is crucial.

Some reliable sources include:

- Bloomberg: Known for comprehensive coverage of global markets and economic events.

- Reuters: Offers accurate, up-to-date news, especially in the world of corporate earnings and macroeconomics.

- The Wall Street Journal: A trusted source for in-depth analysis of financial markets and corporate developments.

- Financial Times: Offers global perspectives on financial markets, economics, and business.

- Morningstar: Great for detailed research on mutual funds, ETFs, and stock performance analysis.

By focusing on these well-established sources, you can ensure that you’re receiving accurate and timely information.

2.3 Subscribe to Niche Newsletters

While broad financial media outlets are important, specialized newsletters can offer more focused insights that align with your investment goals. For instance:

- The Motley Fool provides actionable stock recommendations with a focus on long-term growth.

- Zero Hedge offers a more contrarian perspective on global financial trends, which can be useful for more experienced investors who want to consider alternative viewpoints.

These niche newsletters often provide deep dives into specific sectors or investment strategies, making them a great supplement to broader financial news.

3. Using Technology to Streamline Data Analysis

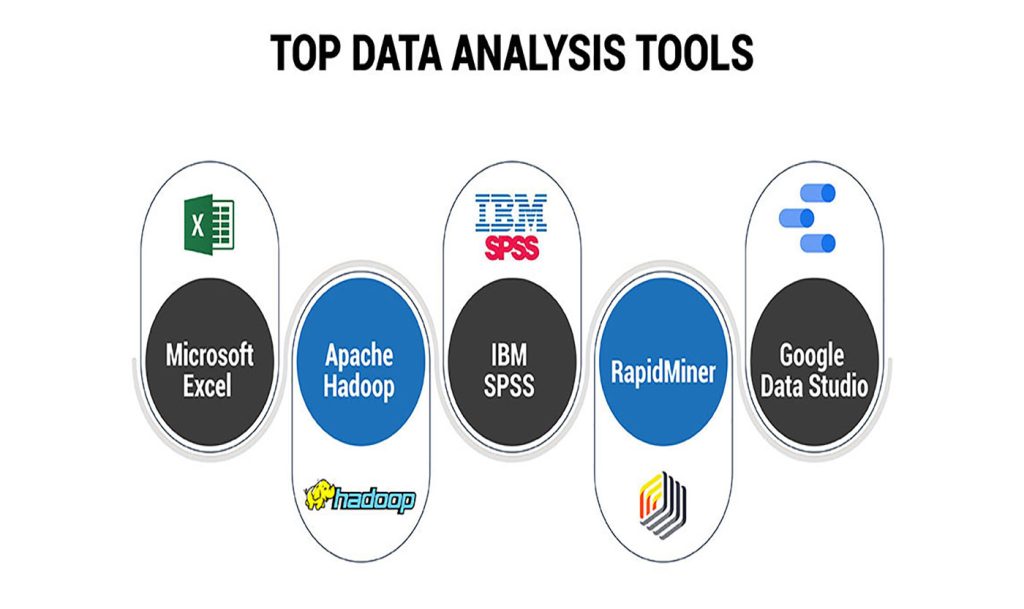

Once you’ve identified the right sources, the next step is to efficiently analyze the data you’re receiving. Financial news and data analysis aren’t just about reading articles—they also involve using tools to process and interpret data. Thanks to modern technology, there are numerous tools available to help investors extract actionable insights from raw data.

3.1 Leverage Financial Data Platforms

Platforms like Yahoo Finance, Google Finance, and Seeking Alpha provide comprehensive financial data that can help you assess the health of a company or sector. These platforms often allow you to compare historical performance, review earnings reports, and access financial statements.

More advanced platforms like Bloomberg Terminal or Refinitiv Eikon offer professional-grade tools for market analysis. While these services are expensive, they are invaluable for institutional investors and those managing large portfolios.

3.2 Utilize Stock Screeners

If you’re looking for specific stocks that meet certain criteria, stock screeners are an excellent tool. Websites like Finviz, TradingView, and Zacks Investment Research offer customizable stock screening tools that can help you identify opportunities based on metrics such as earnings growth, price-to-earnings ratios, dividend yield, and other key factors.

Screeners can help save time by narrowing down your options to only those stocks that meet your predefined parameters. From there, you can dive deeper into individual stock performance, company news, and other factors.

3.3 Monitor Sentiment with AI and Machine Learning Tools

In addition to traditional tools, there are emerging technologies such as artificial intelligence (AI) and machine learning that can help investors filter information and identify trends. AI-powered platforms like Kavout and AlphaSense offer sentiment analysis, which involves parsing through large volumes of financial data, news articles, and social media to gauge the sentiment surrounding a stock, sector, or market event.

These platforms use natural language processing (NLP) algorithms to identify positive or negative sentiment in the news, helping investors assess how a company or sector might be perceived by the market.

4. Key Metrics to Focus On

With the right tools and sources in place, it’s time to focus on the key metrics and data points that matter most to your investment decisions. Not all financial news or reports will be relevant to every investor, so it’s important to know which metrics are worth your attention.

4.1 Earnings Reports

For stock investors, earnings reports are one of the most important pieces of information. They provide insight into a company’s profitability, revenue growth, and future prospects. When analyzing earnings reports, focus on:

- Earnings per share (EPS): This tells you how much profit the company is making on a per-share basis.

- Revenue growth: Indicates whether the company is increasing its sales over time.

- Guidance: Many companies provide future outlooks that can influence stock prices.

4.2 Economic Indicators

Economic indicators such as GDP growth, unemployment rates, and consumer confidence can give you a broader picture of the economic landscape. For example, a rising GDP suggests a growing economy, which could benefit stocks in cyclical sectors like consumer goods and industrials. On the other hand, an increase in unemployment may indicate an economic slowdown, which can negatively affect stock prices across various sectors.

4.3 Inflation and Interest Rates

Inflation and interest rates are key determinants of investment returns. Rising inflation can erode the value of fixed-income investments, while rising interest rates can dampen economic growth. Investors should pay attention to central bank announcements, particularly from the Federal Reserve or the European Central Bank (ECB), to understand the direction of interest rates.

4.4 Industry-Specific News

Finally, keep an eye on industry-specific news. For instance, if you’re investing in the tech sector, you should be aware of regulatory changes, technological innovations, or shifts in consumer demand. Similarly, energy investors should stay up to date on oil prices, supply chain disruptions, and geopolitical events affecting the energy markets.

5. Avoiding Common Pitfalls

Despite having the right sources, tools, and strategies in place, there are still common pitfalls that investors can fall into when analyzing financial news and data. These include:

- Overreacting to short-term news: Short-term market movements are often driven by emotion rather than fundamentals. It’s essential to stick to your long-term strategy and avoid knee-jerk reactions.

- Confirmation bias: It’s easy to seek out news that supports your existing beliefs or positions. To avoid this, make sure you actively seek opposing viewpoints and stay open to changing your perspective based on new information.

- Ignoring the context: Sometimes, financial news can be misleading if you don’t understand the broader context. Always take the time to analyze the full picture before making decisions.

In today’s information-rich world, the ability to efficiently filter valuable financial news and data is crucial for successful investing. By developing a systematic approach to news consumption, using the right tools, and focusing on the most relevant metrics, you can gain a competitive edge in the market. With the right strategies in place, you’ll be well-equipped to navigate the complex world of finance and make informed, data-driven investment decisions.